Rebalancing Acrobatics

Rebalancing Acrobatics

China’s high-flying economy is starting to lose altitude. The big question is how China will rebalance its growth model to address major challenges and imbalances that come along with the economic growth deceleration. Louis Kuijs, Project Director of Hong Kong-based Fung Global Institute (FGI), shared his views in an article published on the FGI website.Edited excerpts follow:

China’s economy is cooling and heading for slowed growth over the medium term. At the same time, China needs to adjust its growth pattern to address major challenges and imbalances. While there is little disagreement on these two points, views differ on the extent of the slowdown and the risks of a hard landing.There is also confusion over the key motivations for rebalancing and which rebalancing policies are essential. For rebalancing to be successful it is important to have appropriate motivations.

China is in for a moderate slowdown this year. Re fl ecting a soft global growth outlook,China’s export prospects are subdued while the domestic economy is also slowing, led by real estate, as the government maintains its tight policy stance towards that sector.However, the deceleration in growth has been mild so far. Looking ahead, a declining inflation rate is giving more room for macroeconomic easing, with pure fi scal stimulus the preferred option. The government also has room to ease the stance toward the property sector once it considers its goal of reining in property prices has been achieved. As elsewhere, risks remain but this policy space makes a hard landing in China unlikely.

Looking at the medium-term drivers of growth, accumulation of labor and total factor productivity (TFP) are likely to decelerate because of demographics and declining scope for further productivity increases after impressive TFP growth over the past 20 years.Human capital accumulation could speed up somewhat but that would not be enough to offset downward pressures. Trying to offset these pressures by further hiking (physical)capital accumulation would not sit well with the government’s rebalancing plans.

The trend toward slower growth, however, is not new and quite gradual. Assuming that fixed-investment growth comes down gradually to 6.6 percent by 2020, GDP growth would ease to an average of around 8 percent in 2012-20, compared to 10 percent in the past three decades. The government’s of fi cial growth target of 7.5 percent for 2012, compared to 8 percent for previous years, caused a stir globally but should not have. It followed the lower growth targets in the 12th Five-Year Plan (2011-15) adopted last year. These targets are not binding in the sense of guiding the macro stance. Actual growth tends to exceed of fi cial targets, often by a large margin.

China needs to adjust its growth model since the current pattern has led to rising imbalances and is not sustainable. But what exactly are the key motivations? Some observers assert that China could soon hit a wall because of fi nancial-economic problems centered on misallocated investment and escalating debt. How likely is this?

Worries

China’s remarkably high investment—an estimated 48 percent of GDP in 2011—poses risks of wastage and compromising on standards, which seem to have risen due to the 2008-10 stimulus package. Overall, China’s infrastructure investment has served the real economy well. Infrastructure utilization rates and standards compare favorably with those in other countries, while in the commercial sphere rates of return on investment also compare well.

On our estimates, economy-wide TFP growth was 3.1 percent in 1995-2011, after subtracting the contribution of human capital.This is high by international comparison and does not suggest large-scale misallocation of investment. China’s incremental capital output ratio went up in recent years because of the investment-based stimulus package and rising share of infrastructure. But during the last fi ve years the ratio was similar to that of India. The setting in which decisions on fi nancing and investment are made in China raises risks of misallocation, which is why financial-sector and corporate governance is important. However, there are so far no convincing signs of systemic over-investment or misallocation. Moreover, with the capitallabor ratio around 15 percent of that in the United States in 2011, capital accumulation still has a long way to go.

Is debt China’s Achilles heel? The corporate sector’s gross debt in China’s bankdominated financial system is estimated at around 100 percent of GDP. The majority of investment in the commercial sphere, however, continues to be financed by retained earnings rather than debt, leaving the corporate sector’s leverage manageable. That is not true for property developers and some of the bank lending to them may go sour. From 2008 to 2010, local government debt rose at an unsustainable pace as a result of borrowing by local government investment platforms to fi nance infrastructure, which lifted total government debt to around two thirds of GDP.That episode did not last very long, though,and such lending has since been reined in.

Even after the recent maturity restructuring, some bank lending to local government investment platforms is likely to go bad, with the burden split between the banks and the Central Government. As part of the credit binge, household debt, largely from mortgages, rose rapidly during the 2008-10 period,although at one third of GDP it remains modest. With much of the debt held within the broader public sector, a fiscally healthy Central Government and low foreign debt amidst still substantial current account surpluses, China’s debt problems are unlikely to become systemic at the macro level.

LESS CROWDED FAIR:Foreign buyers show interest in electronic scales at the 111th Canton Fair opened on April 15 in Guangdong Province. The fi rst phase of the fair (April 15-19) registered a decrease in deal volume compared with the previous one

The key motivations for changing China’s growth pattern lie largely outside of the narrow financial-economic realm.But that does not make them less important.The investment- and industry-heavy pattern of growth has led to several imbalances.Since the late 1990s, in a policy setting too favorable to industry and capital, fl ourishing industrial firms ploughed back increasingly large pro fi ts into new capacity, while wage increases lagged productivity growth.With pro fi ts rising, the wage bill and household income declined as a share of GDP.Combined with low deposit rates and a rising household saving rate—in no small part due to rising income inequality accentuated by this growth pattern—this reduced the role of consumption and made external surpluses swell. External surpluses have come down recently, but that could be temporary in the absence of rebalancing. This growth pattern was also very tough on the environment and led to intense use of natural resources and energy.

Seeking rebalance

China needs to rebalance the pattern of growth away from industry and investment toward services and consumption.

Such a shift would mean more laborintensive growth, with more urban employment creation. By boosting the share of wages and household income in GDP, this would increase the role of consumption in a way that is economically sustainable and would lower the external surplus. Such rebalancing would also make growth less intensive in energy and resources and less detrimental to the environment.

As to how to rebalance, many observers emphasize financial sector reform and exchange rate appreciation. These are important measures. They would, however, need to be part of a comprehensive set of reforms to channel new resources to new sectors, rather than traditional ones, and to support more full migration to the cities, with migrants able to behave and spend like full-blown urban citizens to foster more labor-intensive, servicesoriented and consumption-based growth there.

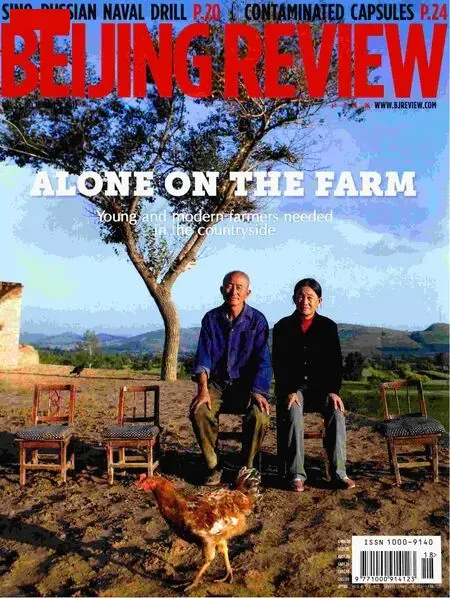

The key reforms include removing the subsidies to industry by raising prices of inputs such as land, energy, water, electricity and the environment; increasing privatesector participation and removing entry barriers in several service industries; improving access to fi nance for small and mediumsized enterprises and service-sector firms;continuing state-owned enterprise dividend reform and actually channeling the revenues to the Ministry of Finance; liberalizing thehukou, or household registration system, and reforming the inter-governmental fiscal system to give local governments the means and incentives to fund public services and affordable housing for migrants; and pursuing land reform to increase the mobility of migrants and, by facilitating land consolidation and mechanization, boost per-capita incomes and consumption in the countryside.

There is nothing obviously dramatic about the easing of trend growth and, from a fi nancial-economic perspective, China’s economy is on a sounder footing than often believed.To successfully rebalance the growth pattern, however, requires a major reform push in many areas, including ones where change would be dif fi cult to pursue.