Cotton Market Fundamentals & Price Outlook

by Cotton Incorporated

Recent price movement

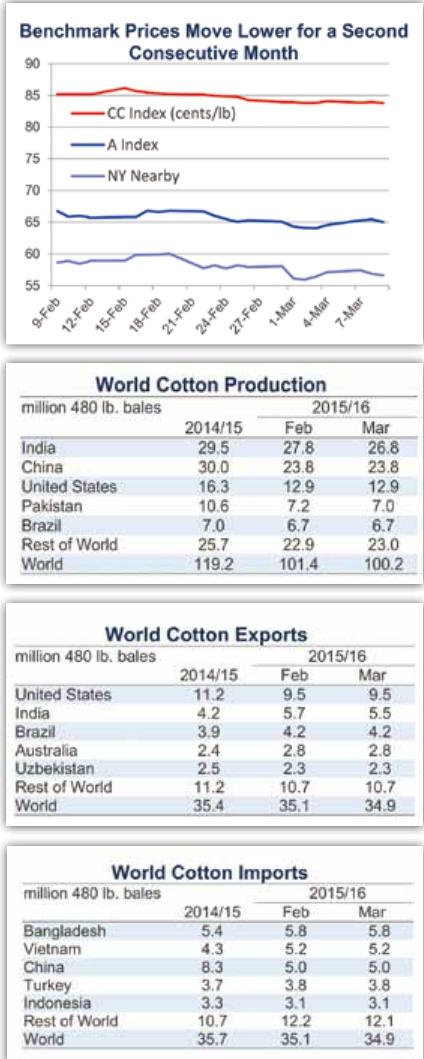

Global cotton prices declined for a second consecutive month.

Values for the nearby May NY futures contract set a series of life-ofcontract lows over the past month, with prices dropping from levels near 59 cents/ lb a month ago to those near 56 cents/lb. Current values are the lowest since 2009.

The A Index also lost about 3 cents/ lb. Recent values have been between 64 and 65 cents/lb.

In international terms, the China Cotton (CC) Index declined from 85 to 82 cents/lb. In domestic terms, the CC Index declined from 12,300 RMB/ton to 12,000 RMB/ton. In both international and domestic terms, the CC Index is at its lowest levels since 2009.

Chinese ZCE futures prices continue to signal further declines in Chinese prices. Values for the most actively traded September contract have been near 10,300 RMB/ton (72 cents/lb).

Prices for the popular Indian Shankar-6 variety were flat to lower in international terms, declining marginally from 63 to 62 cents/lb. In local terms, values decreased from 33,400 to 32,900 INR/ candy.

Pakistani spot prices declined slightly, from 62 to 61 cents/lb in international terms. Domestic prices drifted marginally lower over the past month, with values easing from 5,400 to 5,250 PKR/maund.

Supply, demand, & trade

Since September, every monthly update to the USDAs supply and demand figures has featured decreases to both world production and consumption. This months report was no exception, with the global harvest number dropping 1.2 million bales (from 101.4 to 100.2 million) and the global mill-use projection falling 400,000 bales (from 109.6 to 109.2 million). Current estimates for both production and mill-use are the lowest since 2003/04.

Essentially all of reduction to the global harvest figure resulted from decreased expectations for India (-1.0 million bales, from 27.8 to 26.8 million) and Pakistan (-200,000 bales, from 7.2 to 7.0 million). For mill-use, the only large country-level revision was for Pakistan(-200,000 bales, from 9.8 to 9.6 million), but there were small downward revisions made for Morocco, Thailand, Iran, South Africa, and Tajikistan. In terms of trade, the only notable revisions were the 100,000 bale reduction to the estimate for Moroccan imports and the 200,000 bale decrease to the projection for Indian exports.

At their annual outlook conference, held in late February, the USDA released a partial set of preliminary forecasts for the upcoming crop year. The first full set of projections will be published in May. In the initial figures released a couple weeks ago, the USDA indicated that production in 2016/17 could increase about 5% (from 100.2 to 105.5 million bales).

Virtually all of the increase in global production is expected to come from improved growing conditions. Pakistan and India suffered from a combination of pest attacks and adverse weather this season. A return to average conditions/ yields in those countries is expected to cause most of the increase in world production next crop year. In the U.S., a very wet spring prevented plantings in Texas and the Mid-South. The assumption of average precipitation patterns this spring are expected to allow U.S. acreage and production to increase by about 10% in 2016/17.

Mill demand (+1%, from 109.2 to 110.5 million) and trade (unchanged at 35.0 million bales) are expected to hold at levels nearly identical to those in the current season. Although the production/use gap is expected to narrow(deficit of five million bales in 2016/17 versus a deficit of nine million bales in 2015/16), mill-use is forecast to exceed production for a second consecutive crop year. This implies a second consecutive decrease in ending stocks. However, world ending stocks are projected to hold to levels that are extremely high by historic standards (99.1 million bales) and this should maintain downward pressure on prices.

Price outlook

As has been the case for the past several crop years, a central variable shaping price direction is Chinese government policy. Rumors of an impending release from Chinese reserves, with prices significantly below current cash values (CC Index), are commonly cited as a primary reason that prices around the world have moved lower over the past couple months. Relative to current CC Index values near 82 cents/lb, prices for forward contracts on Chinas CNCE platform (contracts with delivery in July and August are trading below 70 cents/lb) as well Chinese ZCE futures (contracts with delivery in September are trading near 72 cents/lb) suggest that Chinese prices could decrease about 15% in coming months.

However, no details regarding an upcoming set of auctions have been officially released. If the expectations for the drop in Chinese prices expressed by CNCE and ZCE markets are confirmed by an upcoming government announcement, there is potential for Chinese spinning mills to become more competitive internationally and for Chinese mill-use to increase. The USDA is expecting China will start to more aggressively move cotton from reserves by lowering prices, and that Chinese mill-use will increase by one million bales in the coming crop year (from 32.0 to 33.0 million bales).

This scenario should be positive for global cotton usage in the long-term, because it suggests Chinese cotton prices will become more competitive with Chinese polyester prices. In the short-term, however, there could also be negative impacts on global demand due to a contraction in Chinese yarn imports. Year-over-year, the volume of Chinese cotton yarn imports were down 10% in December and down 27% in January. The degree to which these decreases are sustained could affect mill demand outside of China and therefore could weigh on prices around the world.

- China Textile的其它文章

- Dear readers

- Moving Toward Sustainability in the Cotton Supply Chain

- Fifth ITMA ASIA+CITME exhibition over 90 per cent sold at close of space application period

- Mercedes-Benz China Fashion Week:“Design +”unveils a new future

- Sustainable metallising textile production developed in Hong Kong POLYU

- Fashion brands and sustainable practices:Differences between American and Chinese consumers