MARCH 2020

by Cotton Incorporated

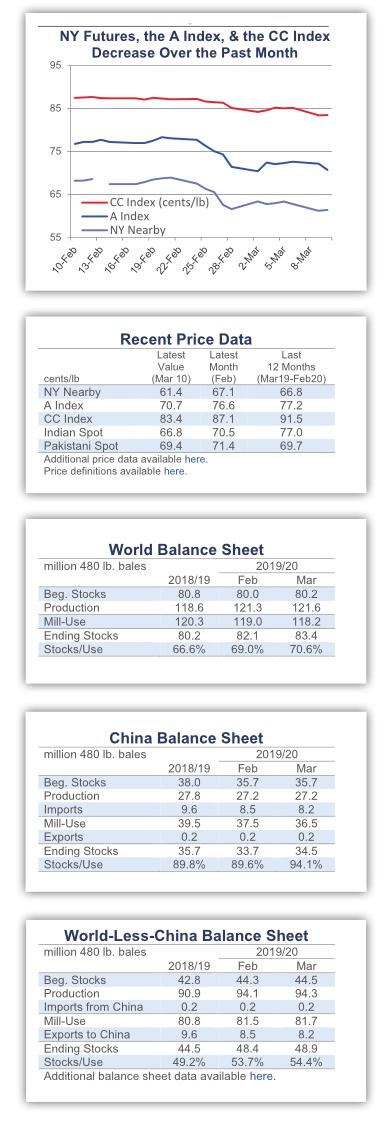

Recent Price Movement

Most benchmark prices declined over the past month.

The nearby May NY futures contract fell from levels near 70 cents/lb in early February to those near 61 cents/lb most recently. Prices for the December contract, which are indicative of expectations after the 2020/21 harvest, moved in the same pattern, but values were slightly higher. Most recently, December futures were trading near 62 cents/lb.

The A Index fell from 77 to 73 cents/lb.

In international terms, the China Cotton Index (CC Index 3128B) decreased from 87 to 85 cents/lb. In domestic terms, prices eased from 13,400 to just below 13,000 RMB/ton. The RMB strengthened slightly against the dollar over the past month, from 6.98 to 6.94 RMB/USD.

Indian cotton prices (Shankar-6 quality) slipped from 71 to 67 cents/lb. In domestic terms, values fell from 39,400 to 38,900 INR/candy. The Indian rupee weakened from 71 to 74 INR/USD.

Pakistani prices were comparatively stable. Levels held near 71 cents/lb in international terms. In domestic terms, values slipped a little, from 9,100 to 9,000 PKR/maund. The Pakistani rupee was also steady, consistently trading near 154 PKR/ USD.

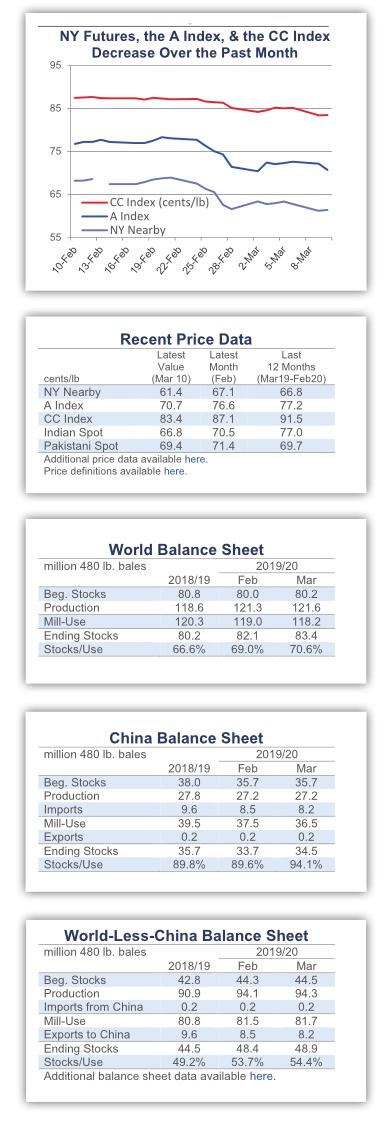

Supply, demand, & trade

The latest USDA report featured a small increase in 2019/20 global production and a decrease in 2019/20 global mill-use. The addition to the world harvest projection was 263,000 bales, bringing the current forecast to 121.6 million. The world consumption figure fell 850,000 bales, bringing the current forecast to 118.2 million.

Along with an increase in beginning stocks (+191,000 bales to 80.2 million), the combination of a larger crop and lower offtake lifted the figure for global ending stocks (+1.3 million bales, to 83.4 million). This number is above the tight range between 80.2 and 80.8 million maintained since 2016/17 but is well below the level of 90.1 million bales in 2015/16.

At the country-level, notable changes to production numbers included those for the U.S. (-302,000 bales, to 19.8 million), Brazil (+300,000, to 13.0 million, matching the record for Brazilian production), Chad(+235,000, to 325,000), and Tajikistan(+130,000 to 570,000).

The largest changes to mill-use figures included a 1.0 million bale reduction for China (to 36.5 million) and 100,000 bale increases for Bangladesh (to 7.4 million) and Turkey (to 7.3 million).

Global trade forecasts were mostly unchanged (+25,000 bales to 43.6 million). Notable changes in import figures included those for China (-250,000 to 8.3 million) and Bangladesh (+100,000 to 7.4 million). The largest revisions for export estimates included those for Brazil (-100,000 to 8.8 million), and Chad (+110,000 to 200,000).

Price outlook

The USDA released preliminary estimates for the 2020/21 crop year at their Agricultural Outlook Forum in late February. Globally, expectations were that production would decrease by about three million bales, to 118.5 million (current 2019/20 number is 121.6 million). World mill-use was expected to tick higher (to 121.0 million bales, the current 2019/20 number is 118.2 million) due to an assumption of stronger global economic growth. In combination, the decrease in production and the increase in consumption were expected to result in a production shortfall of about three million bales.

The corresponding reduction in global ending stocks would put carryout at the end of the upcoming crop year just below 80 million bales. That level would be marginally below the range between 80.2 and 80.8 million bales that was maintained between 2016/17 and 2018/19. A drop below that range could be interpreted as a positive for cotton prices (crop year averages for the NY nearby were between 73 and 79 cents/lb between 2016/17 and 2018/19).

However, even though these figures are only a few weeks old, the rapid spread of the coronavirus has significantly altered macroeconomic conditions and makes the recent USDA estimates for 2020/21 feel dated. The Organization for Economic Cooperation and Development(OECD, a group representing 36 nations with a goal of promoting global growth) ventured a revised forecast for global GDP growth in 2020 in early March that suggested a 2.4% increase in economic activity. If realized, this would be below the 2.9% growth rate experienced in 2019 and would be in the opposite direction of the acceleration in global GDP assumed by the USDA in their early 2020/21 forecasts.

In 2019, global growth was the slowest since the financial crisis. Deceleration from that weak level does not suggest strength on the demand side of the balance sheet and implies downward risk to consumption estimates. Including March, there are still five months remaining in the 2019/20 crop year, meaning there is ample time for the coronavirus and the slowdown in economic activity, and it can bring to lower expectations for the current crop year as well as the upcoming 2020/21 season.

The USDA lowered its consumption number for China this month. Reports are that China is returning to a more normal set of business conditions already, which could mean that further decreases in Chinese consumption could be limited. Nonetheless, delays have been registered throughout supply chains. The resulting logistical bottlenecks, along with the spread of the virus beyond China, pose risks to demand. If global conditions do not clear up quickly, weakness from the demand side could erase the production deficit projected by the USDA in 2020/21.

It remains very early for 2020/21. Planting is just starting in a few warmer regions of the northern hemisphere, and there is a lot of weather to be experienced before the next harvest. The coronavirus and macroeconomic conditions dominate demand-related concerns at the moment, but the trade dispute and its potential impacts should not be forgotten. The Phase One agreement is now in effect. If the targets laid out in the agreement are not met, further escalation may occur from both sides. The trade dispute has been identified as a contributing factor for the economic slowdown in 2019. If tensions flare again in 2020, economic growth could end up being lower than currently expected.

- China Textile的其它文章

- aining China International Home Textiles Cloud Expo goes live this year,launching a new“cloud”model

- Strike hard to maintain the order of the melt blown nonwovens market

- A 500K Ton/Year PET Project Breaks Ground in Korla,Bayingol Mongolia of Xinjiang

- A Glimpse of Industrial Park in Xinjiang amid Virus Fighting

- From January to March,the profits of industrial enterprises above designated size decreased by 36.7%

- Manmade fiber industry hit hard with profits fallout by 75%