世界經濟主要指標

國家統計局國際統計信息中心

?

·國際統計數據·

世界經濟主要指標

國家統計局國際統計信息中心

一、世界經濟

表1 世界經濟增長率(上年=100) 單位:%

注:1.國際貨幣基金組織公布的世界及分類數據按照購買力平價方法進行匯總,世界銀行和英國共識公司按匯率法進行匯總。2.印度數據指財政年度。2013年、2014年度數據為印度官方大幅上修后數據,而2015年及2016年數據系參照官方修訂后數據的預測結果。3.各經濟體2013年、2014年數據已據其官方發布結果作了調整。

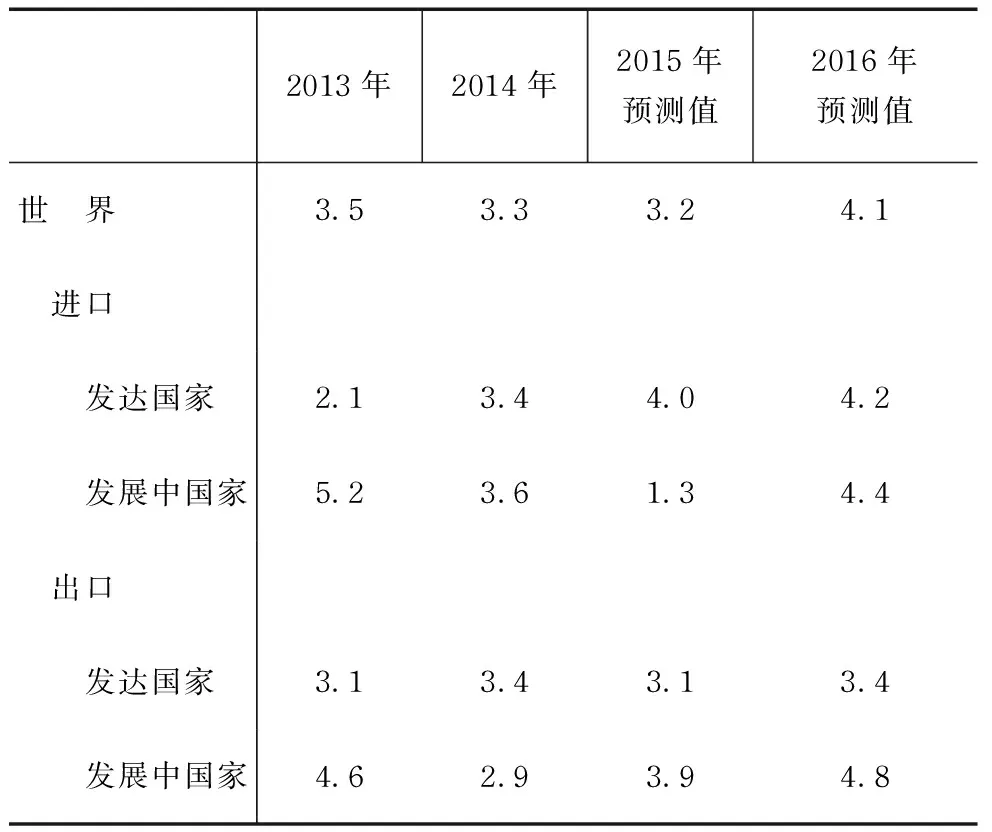

表2 世界貿易量增長率(上年=100) 單位:%

注: 包括貨物和服務。

資料來源: 國際貨幣基金組織2015年10月預測。

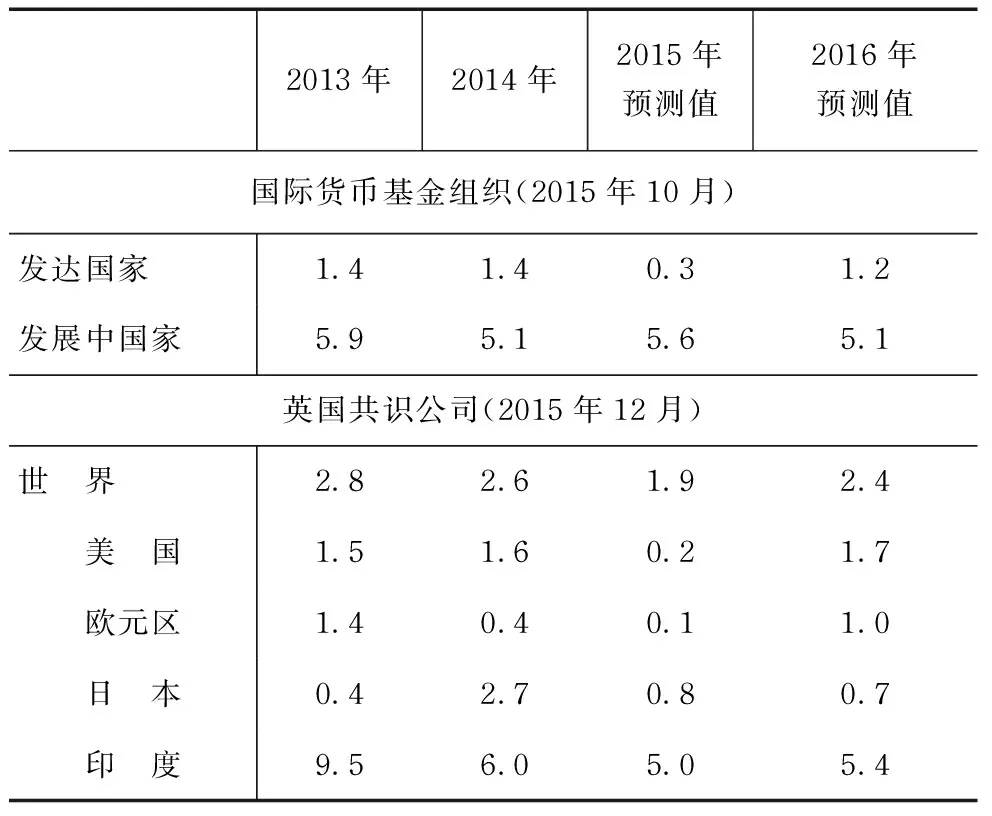

表3 消費者價格漲跌率(上年=100) 單位:%

注: 1.印度來源于英國共識公司的數據指財政年度。2.各經濟體2013年、2014年數據已據其官方發布結果作了調整。

表4 消費者價格同比上漲率 單位:%

資料來源:世界銀行數據庫。

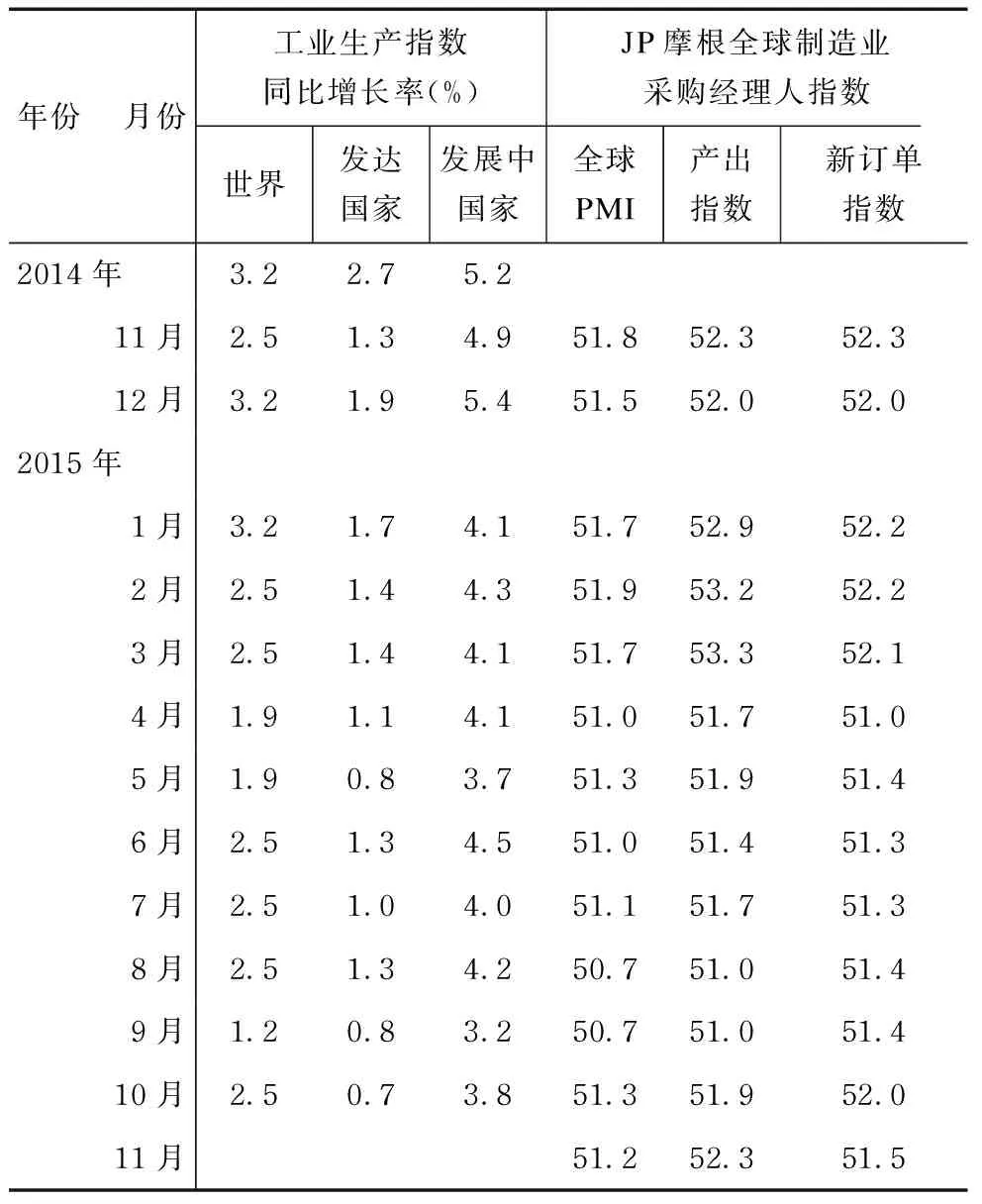

表5 工業生產

年份月份工業生產指數同比增長率(%)JP摩根全球制造業采購經理人指數世界發達國家發展中國家全球PMI產出指數新訂單指數2014年3.22.75.211月2.51.34.951.852.352.312月3.21.95.451.552.052.02015年1月3.21.74.151.752.952.22月2.51.44.351.953.252.23月2.51.44.151.753.352.14月1.91.14.151.051.751.05月1.90.83.751.351.951.46月2.51.34.551.051.451.37月2.51.04.051.151.751.38月2.51.34.250.751.051.49月1.20.83.250.751.051.410月2.50.73.851.351.952.011月51.252.351.5

注:1.工業生產指數同比增長率為經季節調整的數據。2.采購經理人指數超過50預示著經濟擴張期。

資料來源:世界銀行數據庫、美國供應管理協會。

二、美國經濟

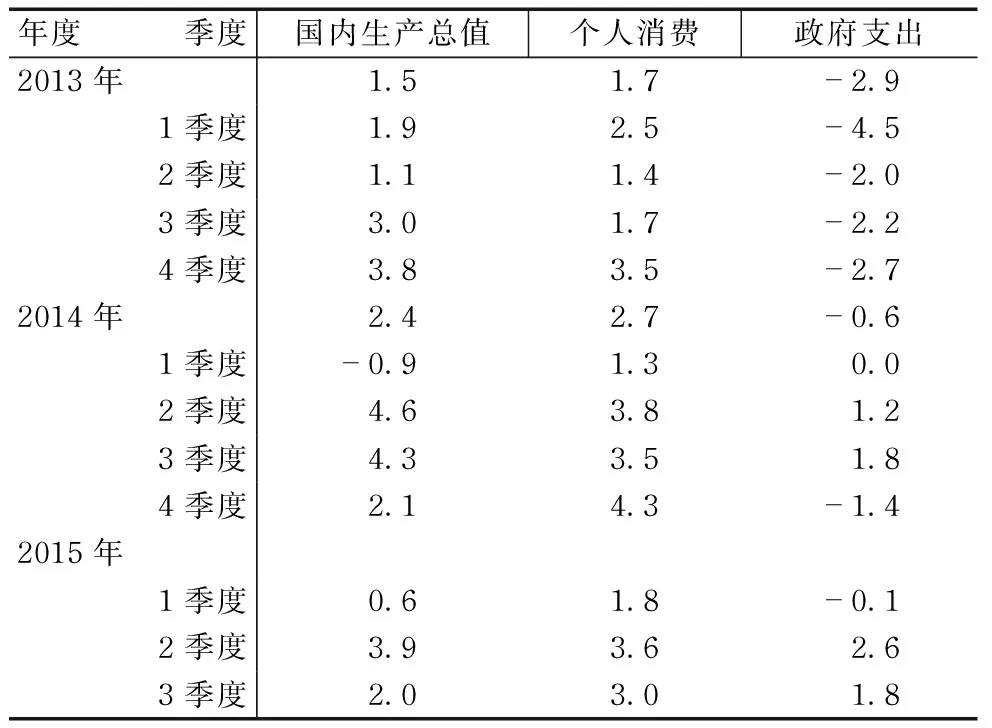

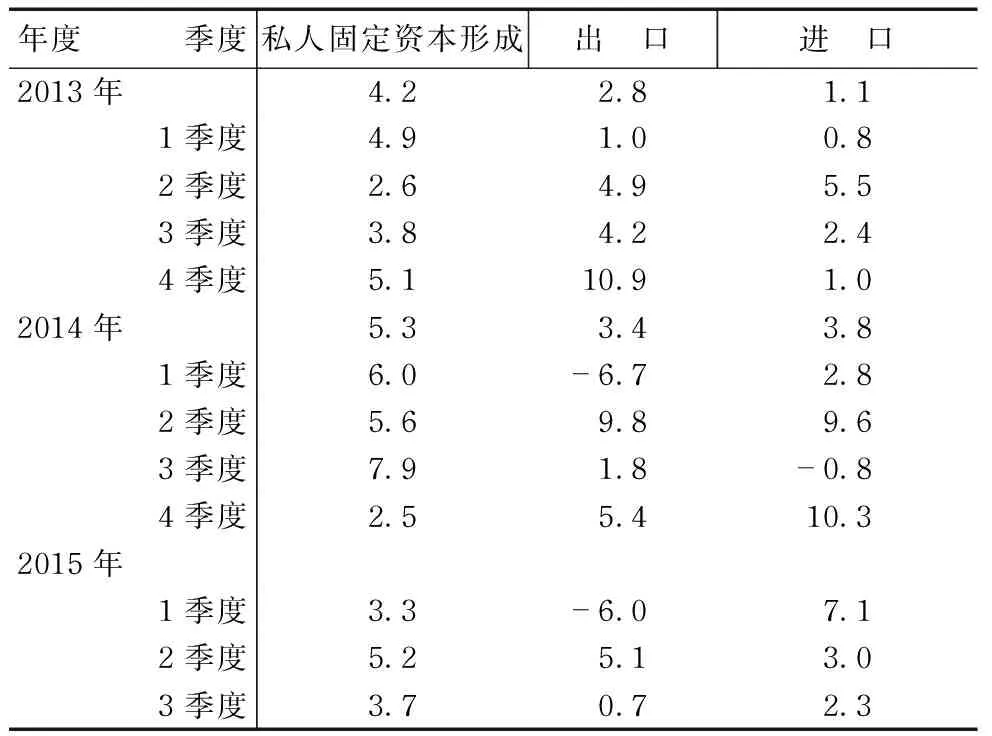

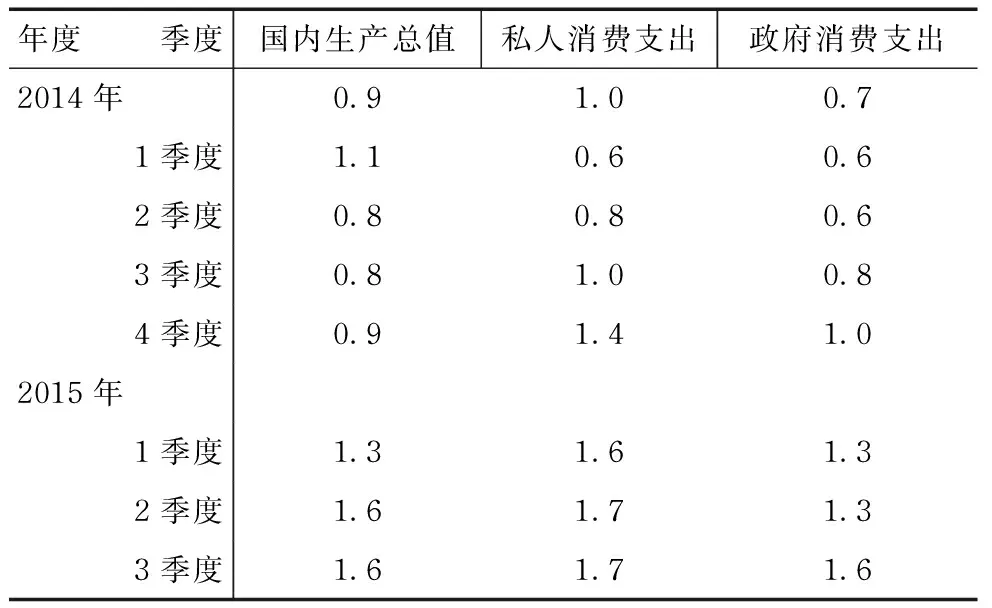

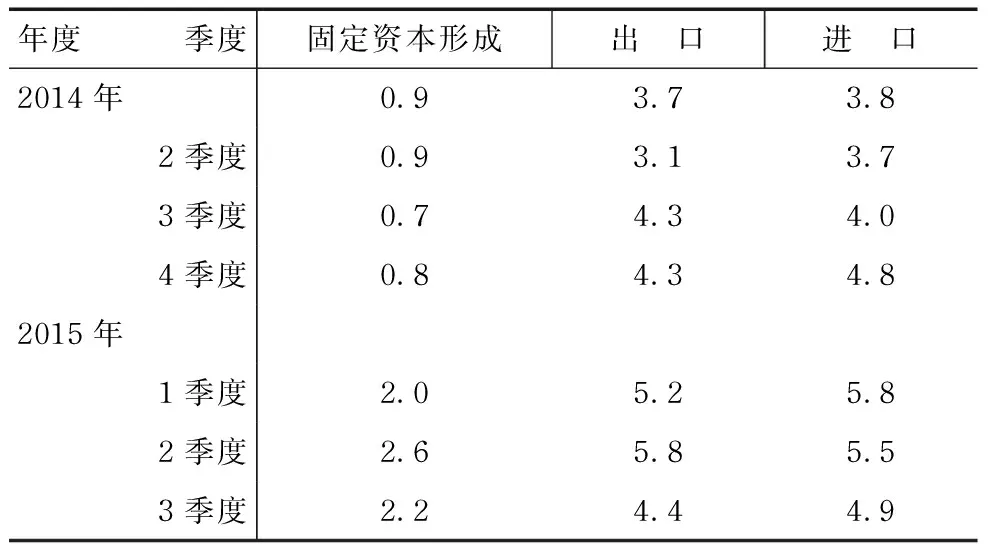

表6 國內生產總值及其構成增長率(環比) 單位:%

表7 國內生產總值及其構成增長率(環比) 單位:%

注:季度數據按季節因素調整、折年率計算(表6、表7)。

資料來源:美國商務部經濟分析局(表6、表7)。

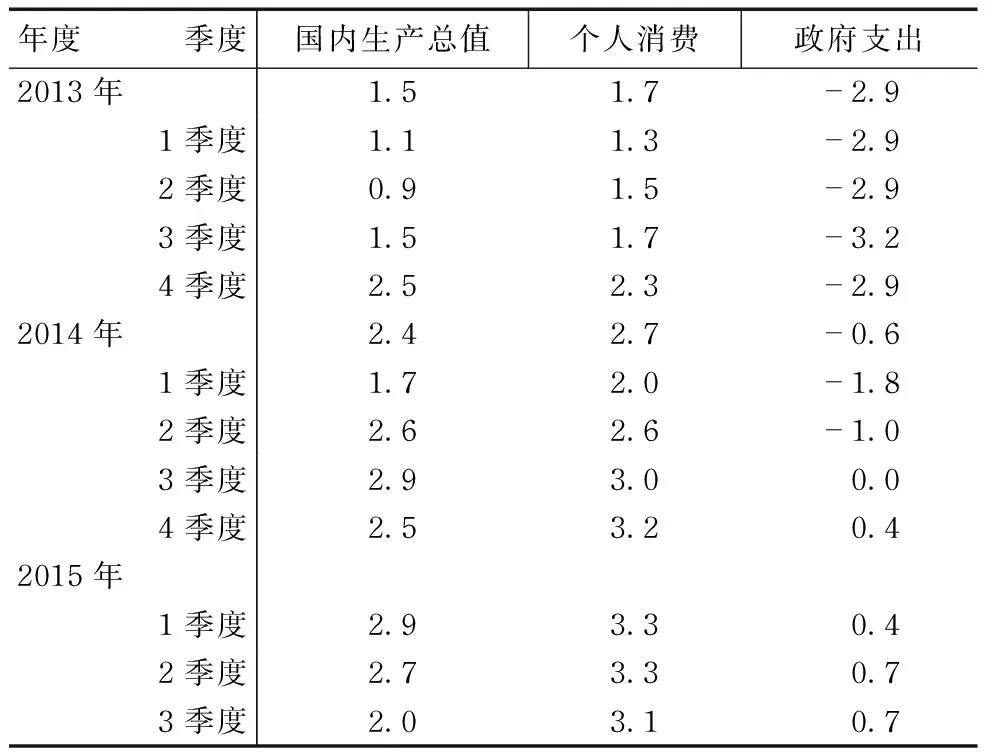

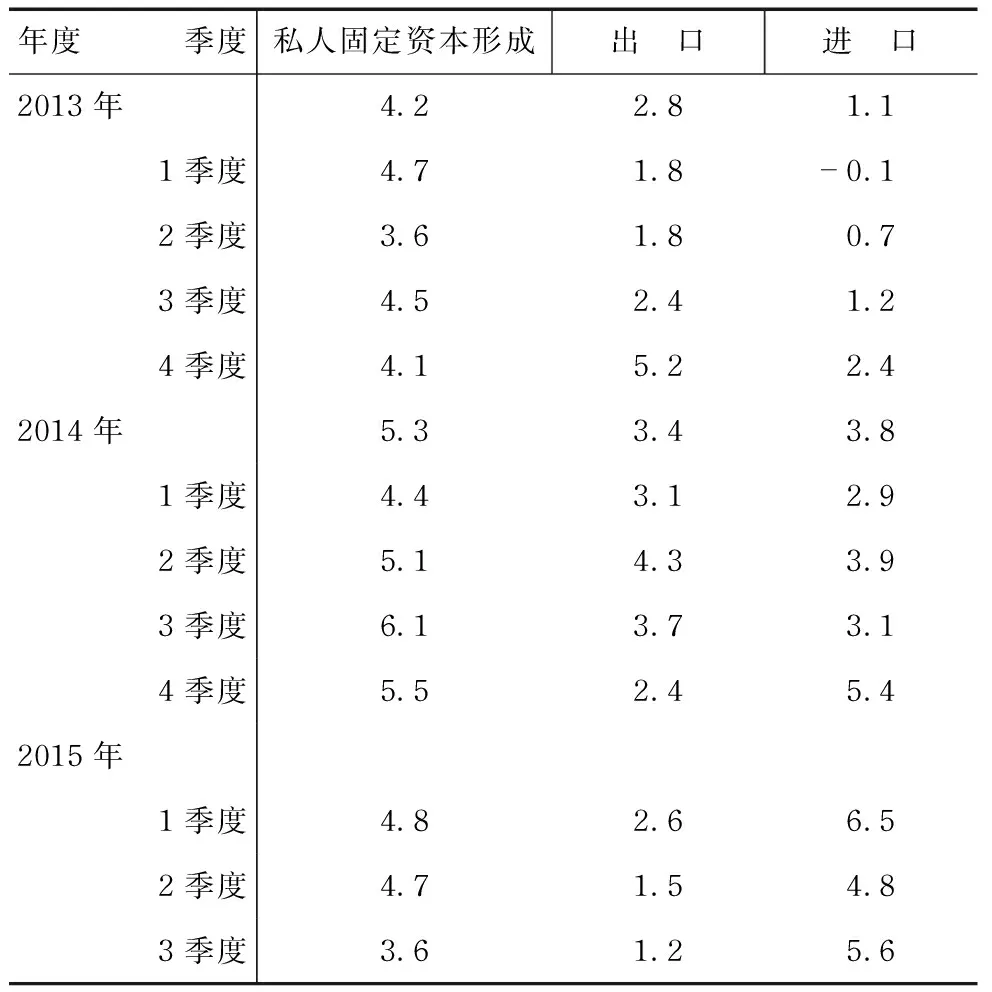

表8 國內生產總值及其構成增長率(同比) 單位:%

表9 國內生產總值及其構成增長率(同比) 單位:%

注:季度數據按季節因素調整(表8、表9)。

資料來源:美國商務部經濟分析局(表8、表9)。

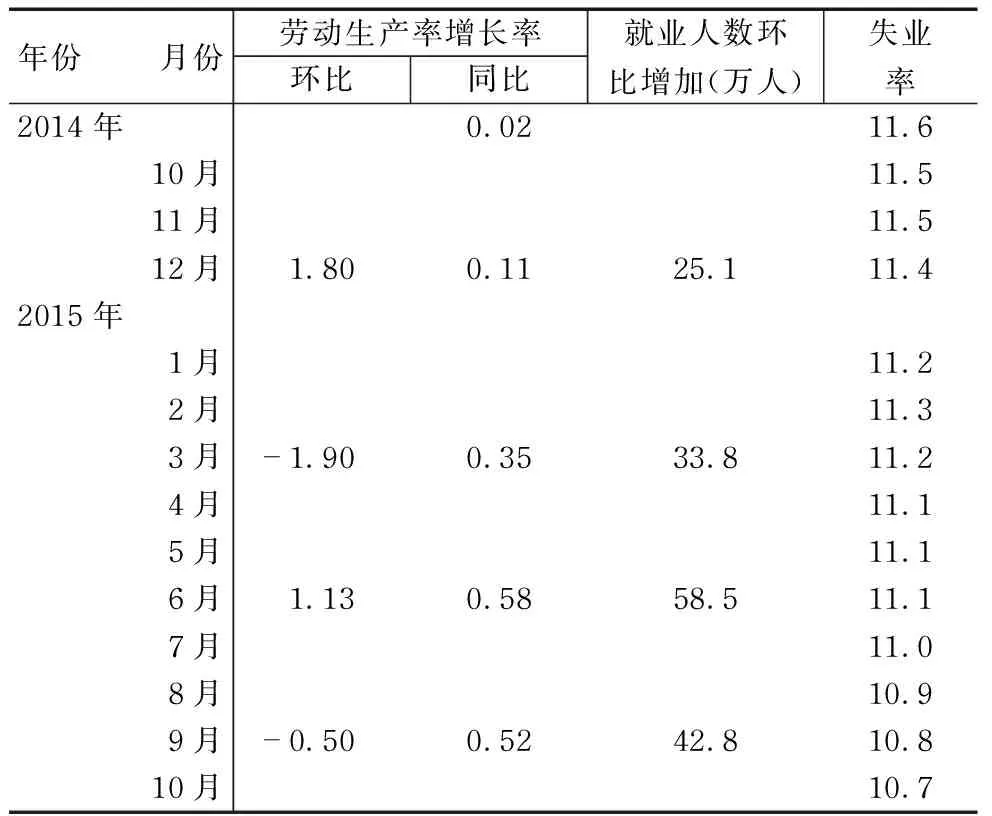

表10 勞動力市場 單位:%

注:除年度數據以外,勞動生產率增長率為該月份所在季度的增長率。

資料來源:美國勞工統計局。

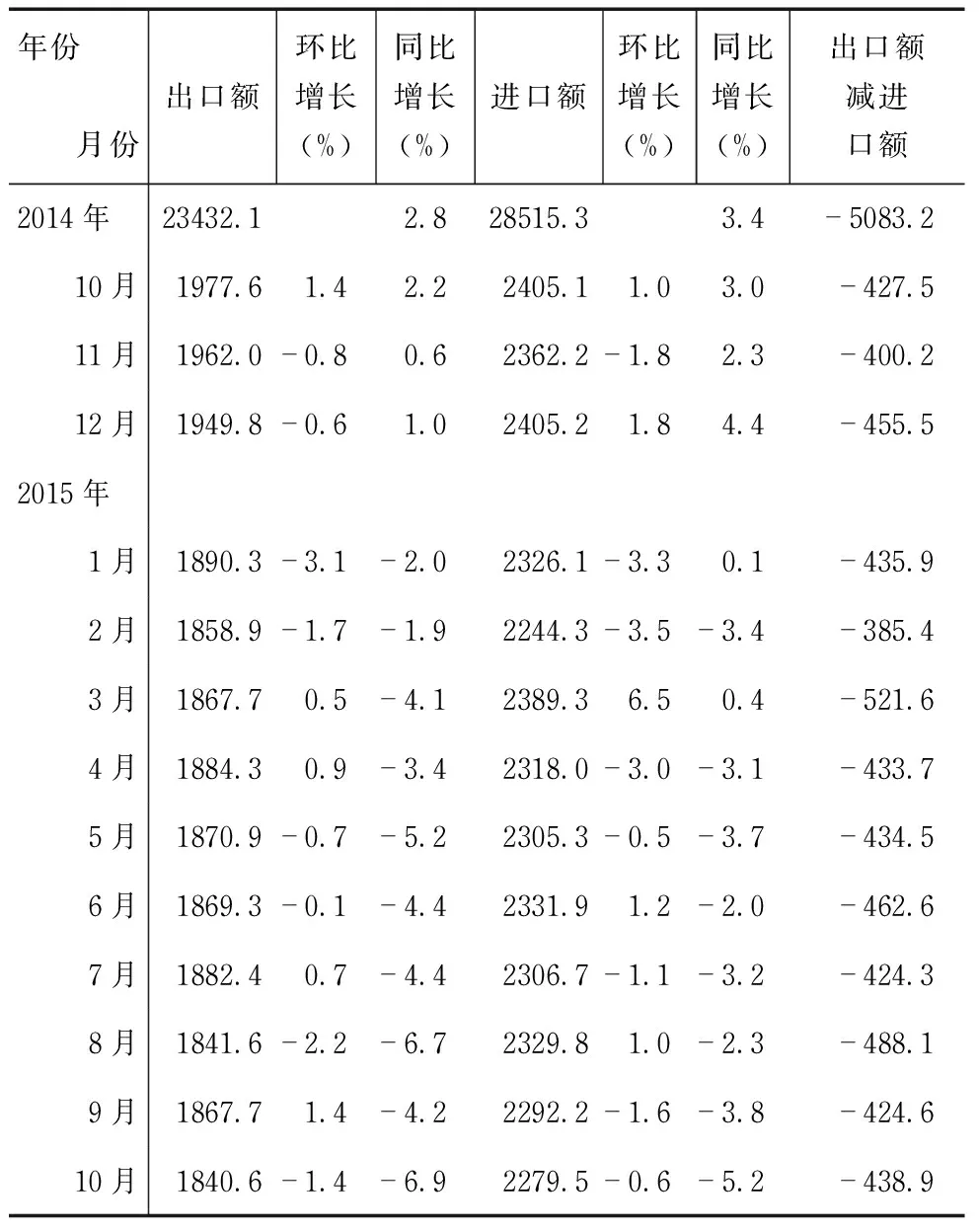

表11 進出口貿易 單位:億美元

注:包括貨物和服務貿易。因季節調整,各月合計數據不等于全年總計數據。

資料來源:美國商務部普查局。

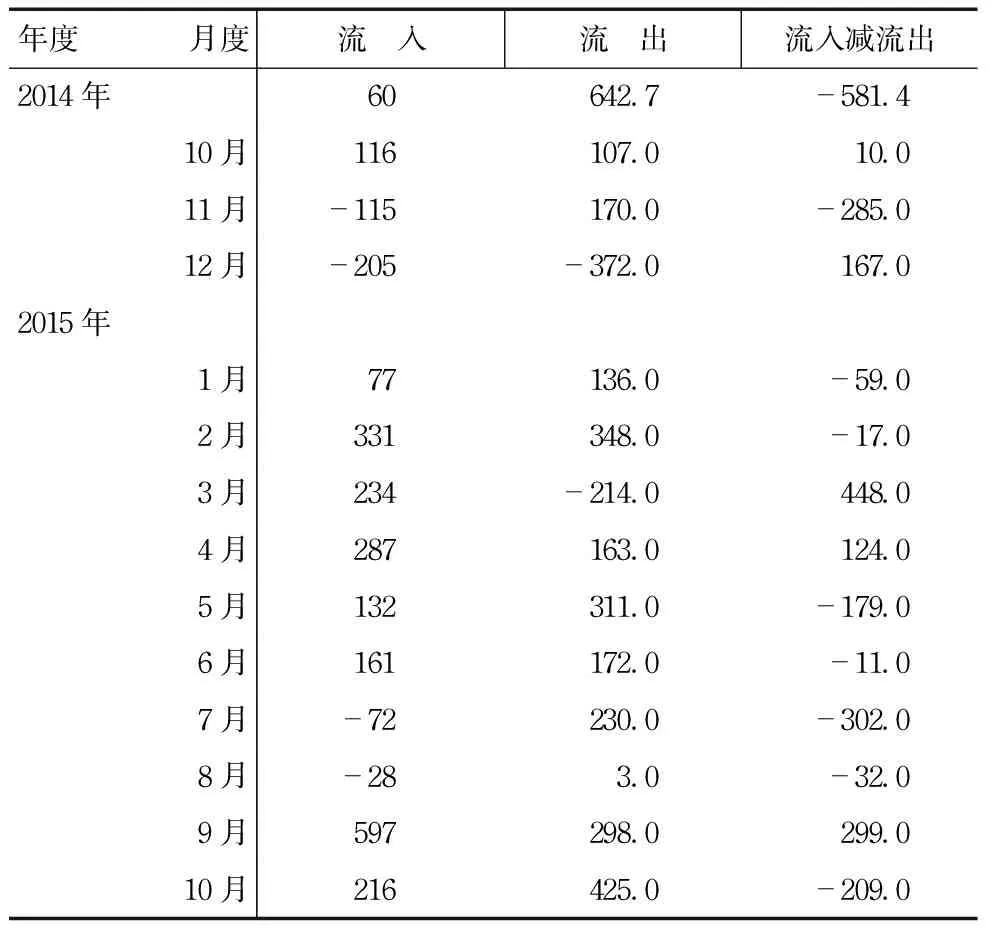

表12 外國直接投資 單位:億美元

資料來源:美國商務部經濟分析局。

三、歐元區經濟

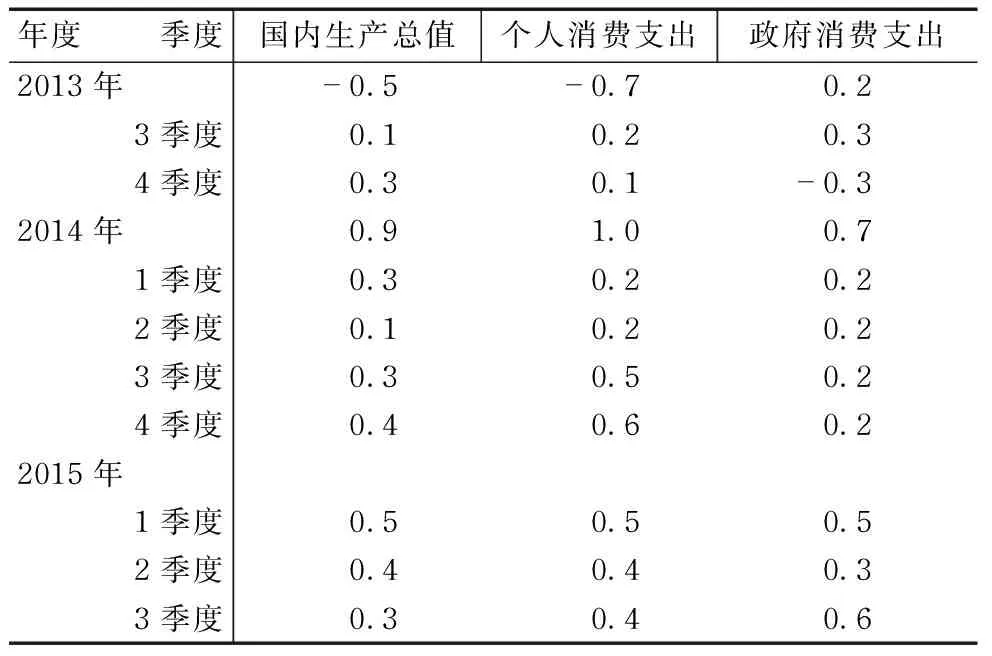

表13 國內生產總值及其構成增長率(環比) 單位:%

表14 國內生產總值及其構成增長率(環比) 單位:%

資料來源:歐盟統計局數據庫(表13、表14)。

表15 勞動力市場 單位:%

注:除年度數據以外,勞動生產率增長率為該月份所在季度增長率;就業人數為該月份所在季度的環比變化。

資料來源:歐洲央行統計月報、歐盟統計局數據庫。

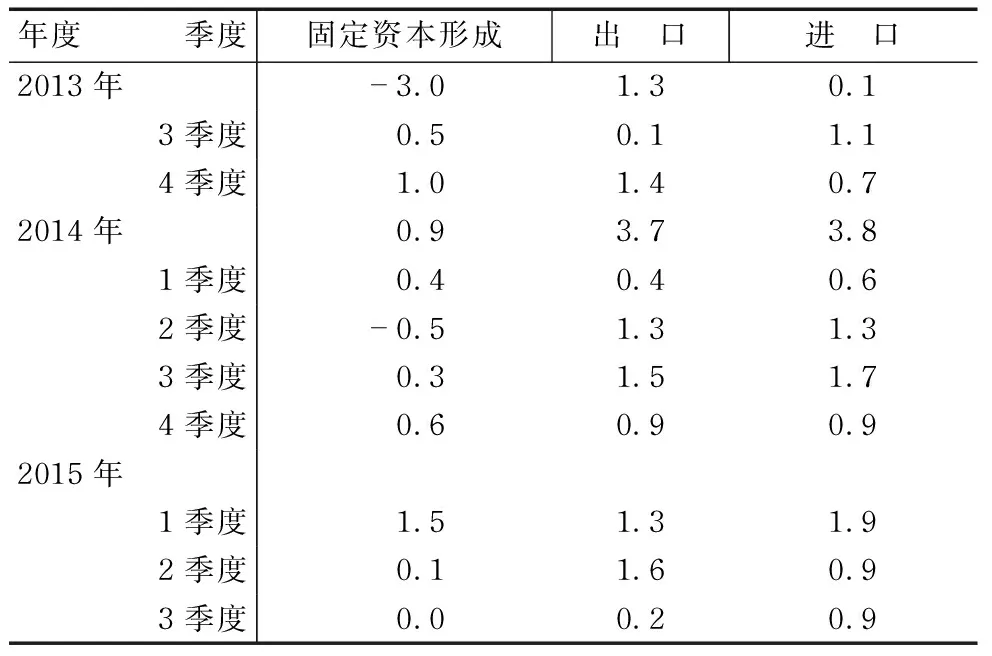

表16 國內生產總值及其構成增長率(同比) 單位:%

表17 國內生產總值及其構成增長率(同比) 單位:%

資料來源:歐盟統計局數據庫(表16、表17)。

表18 進出口貿易 單位:億歐元

注:歐元區絕對數指歐元區現有范圍,即19個成員國。貿易額不包括歐元區各成員國相互之間的貿易額,為經季節調整后的數據。

資料來源:歐盟統計局數據庫。

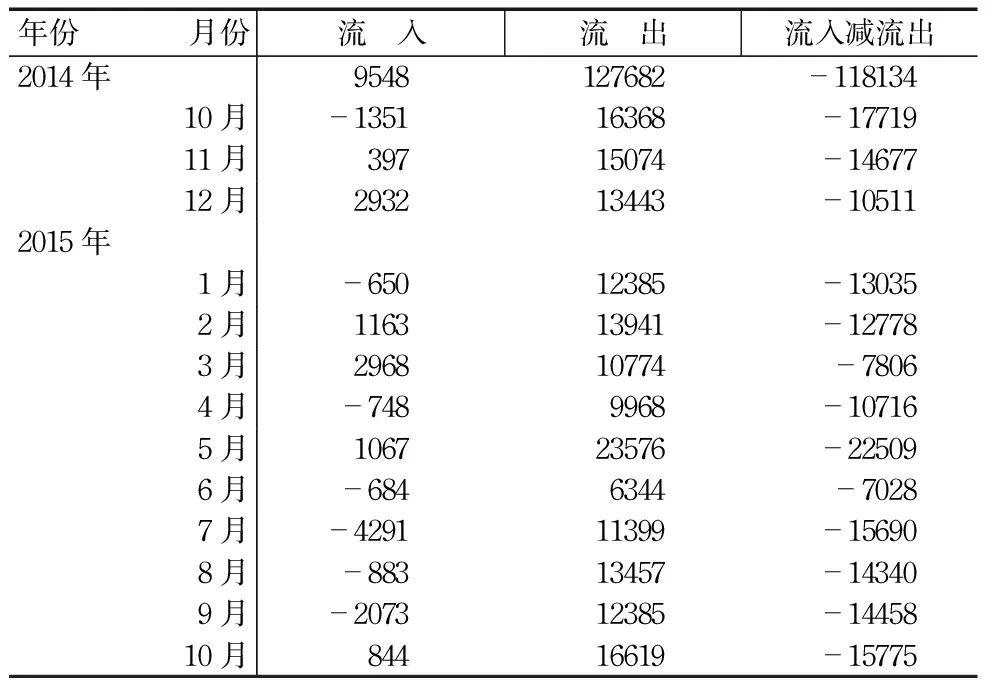

表19 外國直接投資 單位:億歐元

注:歐元區絕對數指歐元區現有范圍,即19個成員國。歐元區外國直接投資額不包括歐元區各成員國相互之間的直接投資額。

資料來源:歐洲央行統計月報。

四、日本經濟

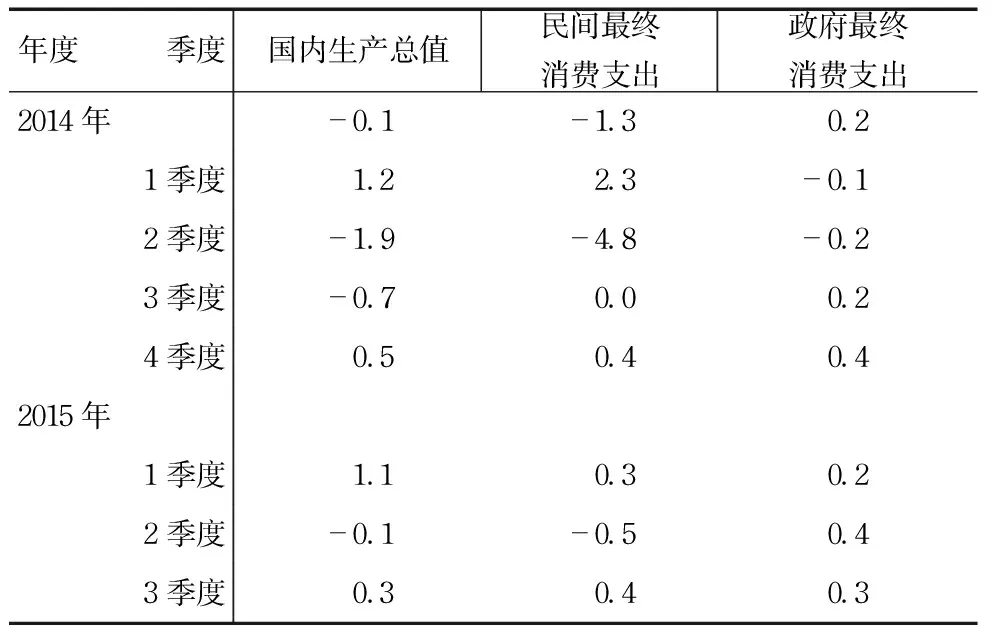

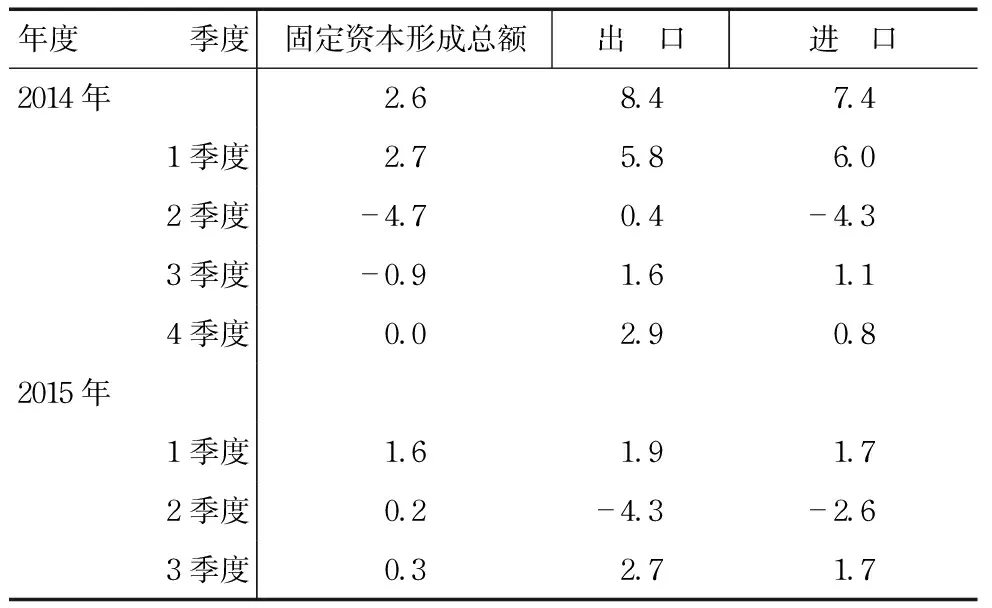

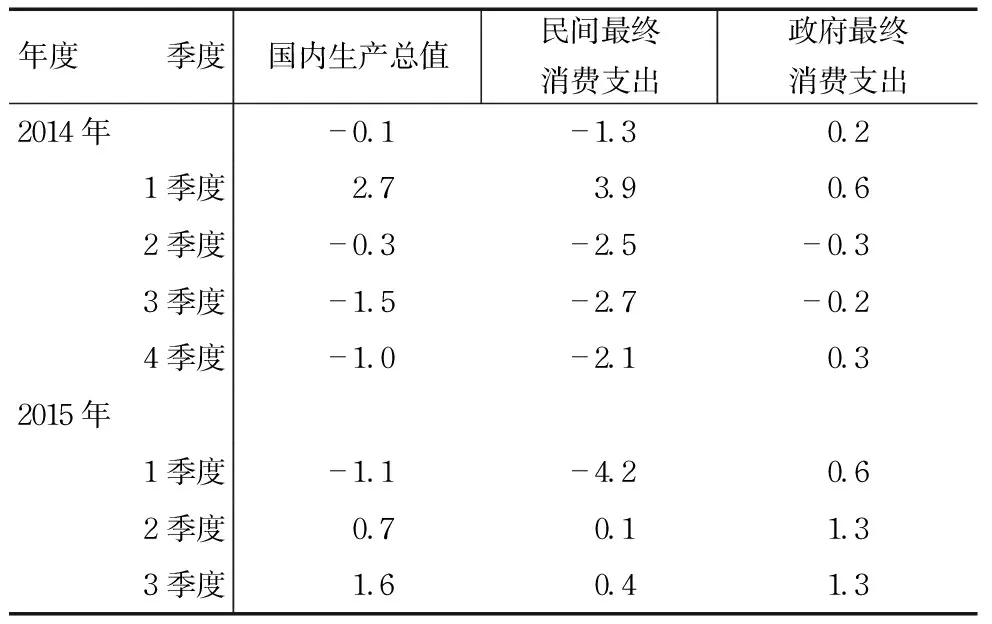

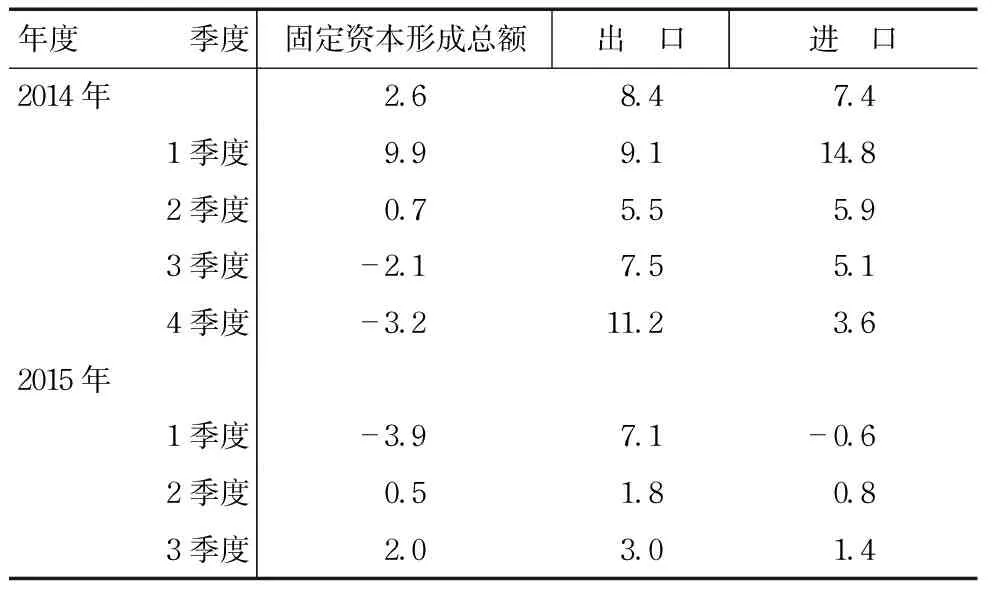

表20 國內生產總值及其構成增長率(環比) 單位:%

表21 國內生產總值及其構成增長率(環比) 單位:%

表22 國內生產總值及其構成增長率(同比) 單位:%

表23 國內生產總值及其構成增長率(同比) 單位:%

資料來源:日本內閣府(表20~表23)。

表24 勞動力市場 單位:%

資料來源:日本統計局和日本央行統計月報。

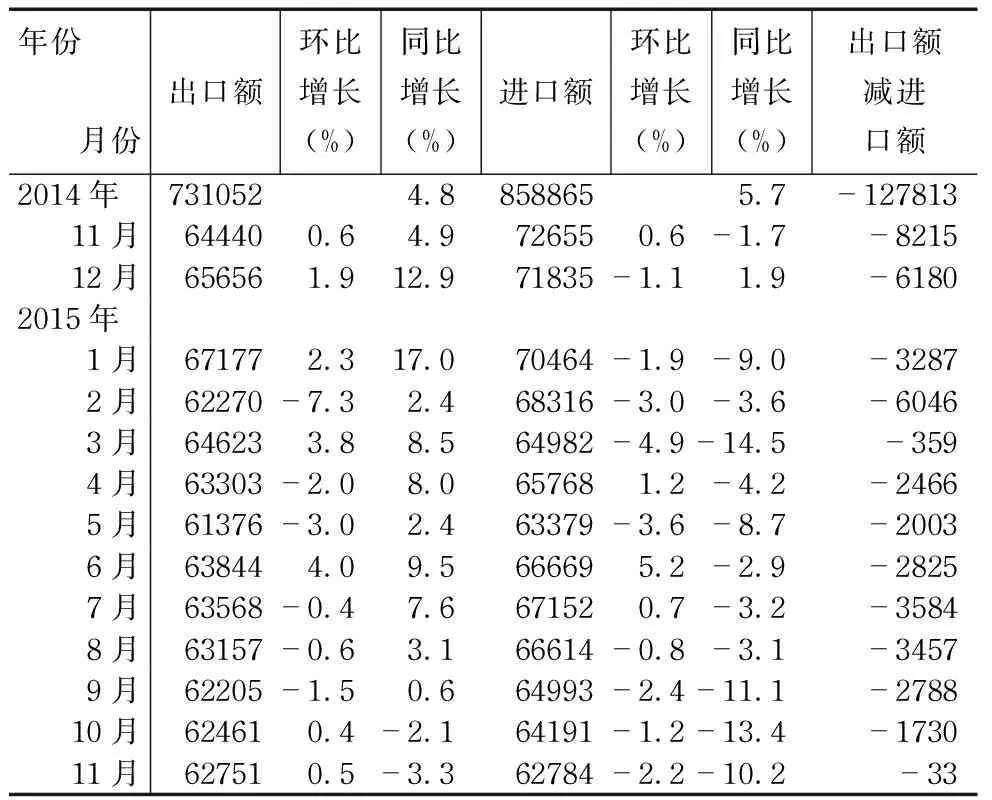

表25 進出口貿易 單位:億日元

注:月度貿易額為季節調整后數據。

資料來源:日本財務省。

表26 外國直接投資 單位:億日元

資料來源:日本財務省。

五、其他主要國家和地區經濟

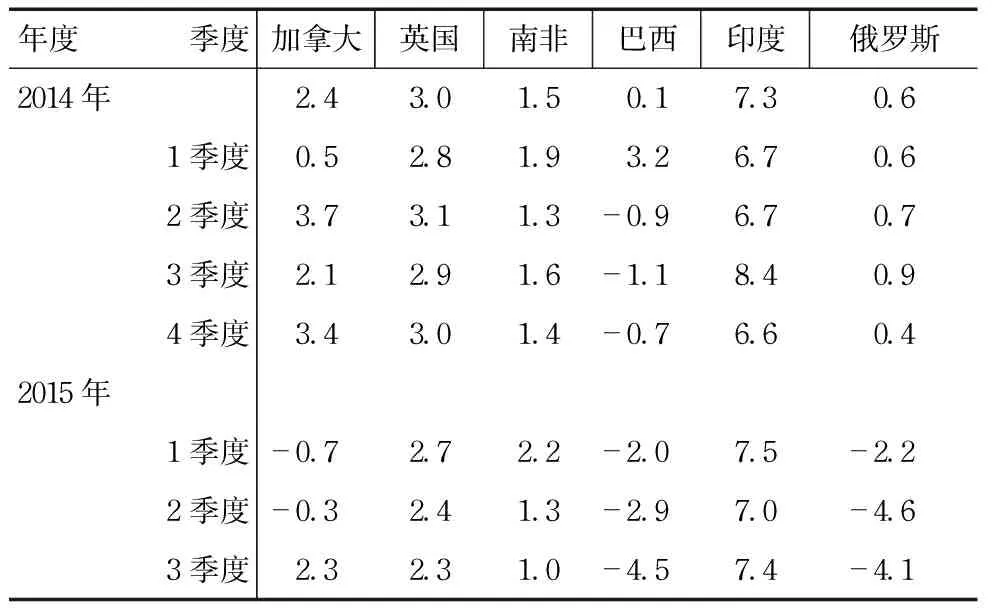

表27 國內生產總值增長率(同比) 單位:%

注:印度年度GDP增長率為財年增長率。

表28 國內生產總值增長率(同比) 單位:%

資料來源:各經濟體官方統計網站。

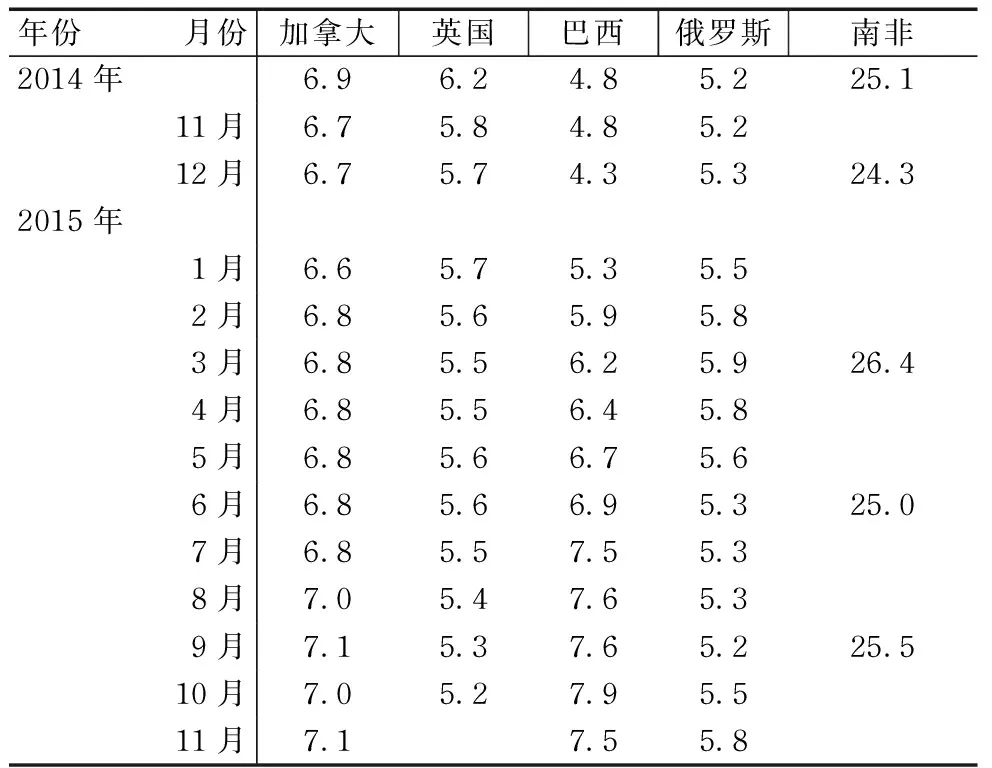

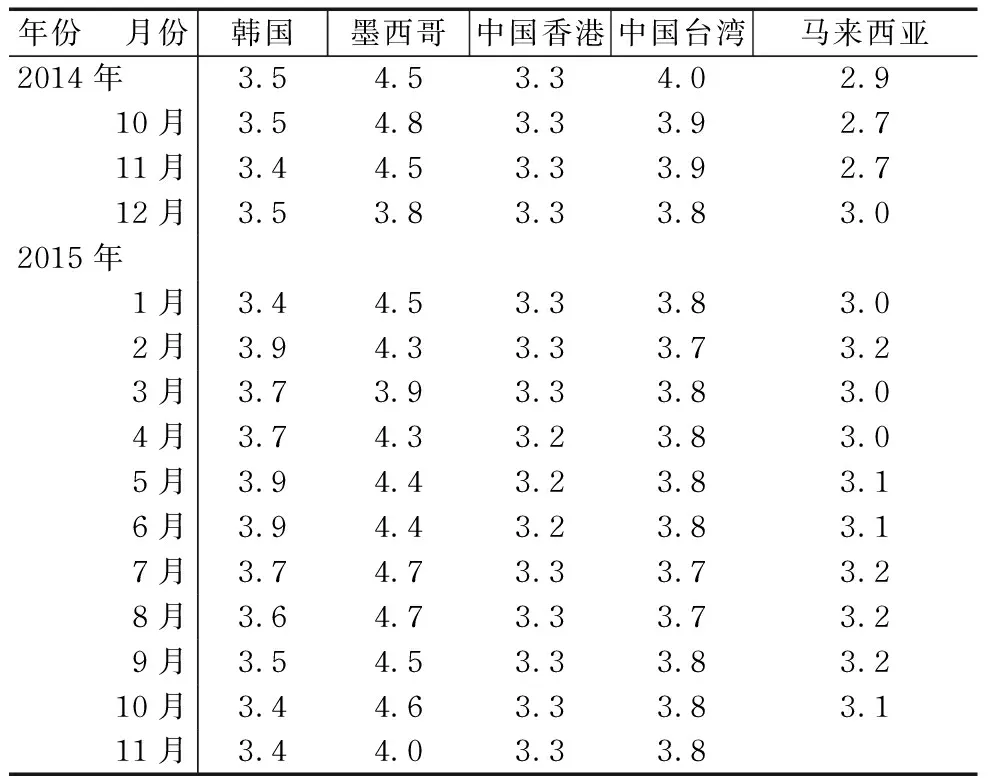

表29 勞動力市場失業率 單位:%

表30 勞動力市場失業率 單位:%

注:1.英國和中國香港月度數據為截至當月的3個月移動平均失業率。2.加拿大、英國、韓國和中國香港為經季節因素調整后的失業率。

資料來源:各經濟體官方統計網站。

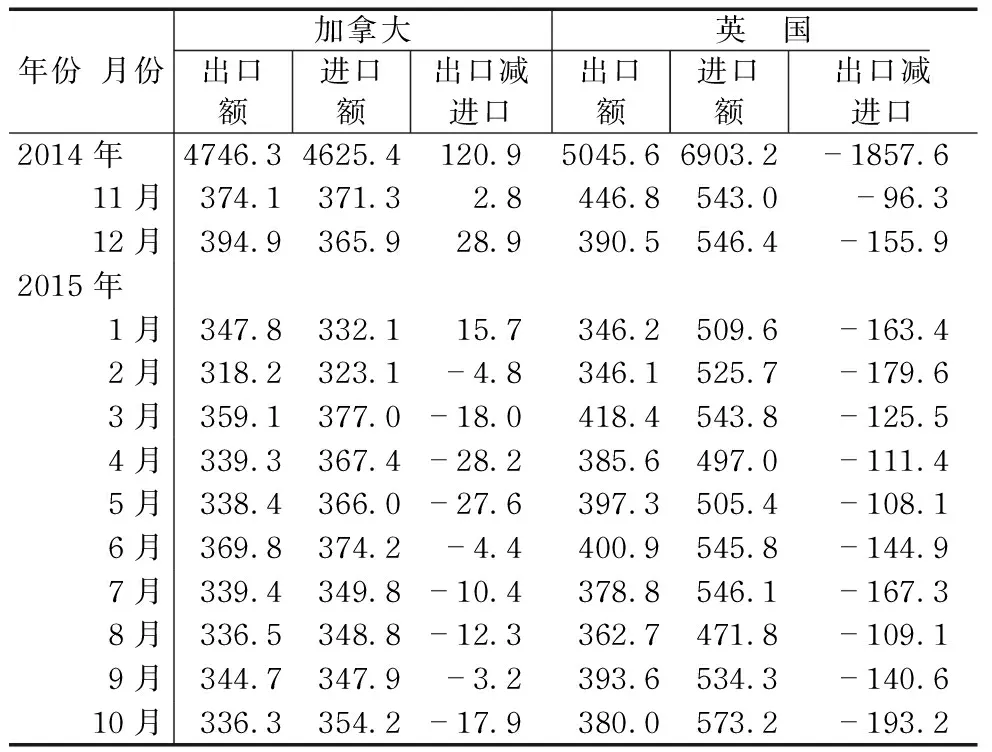

表31 進出口貿易 單位:億美元

注:加拿大和英國數據經過季節因素調整。

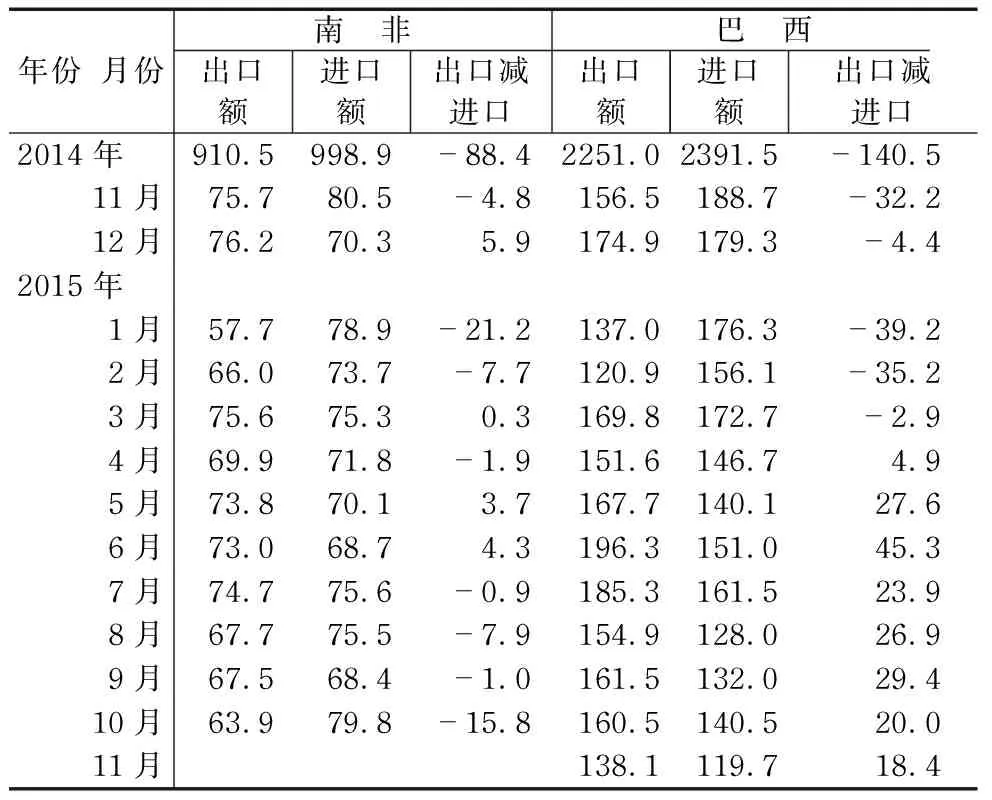

表32 進出口貿易 單位:億美元

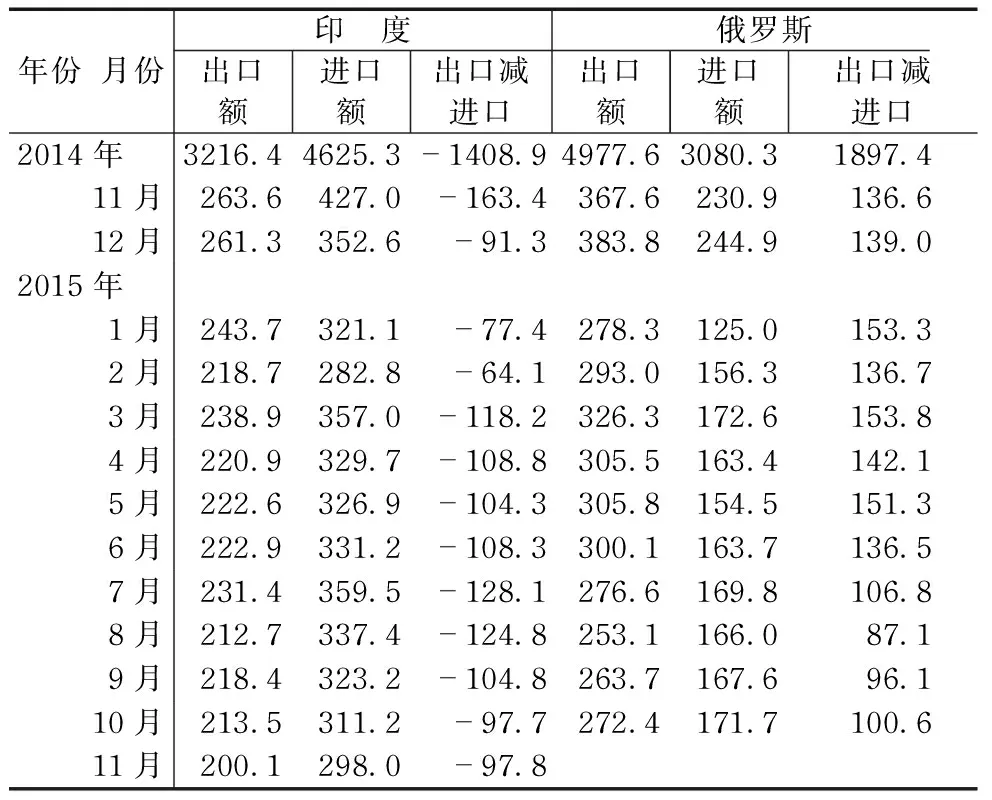

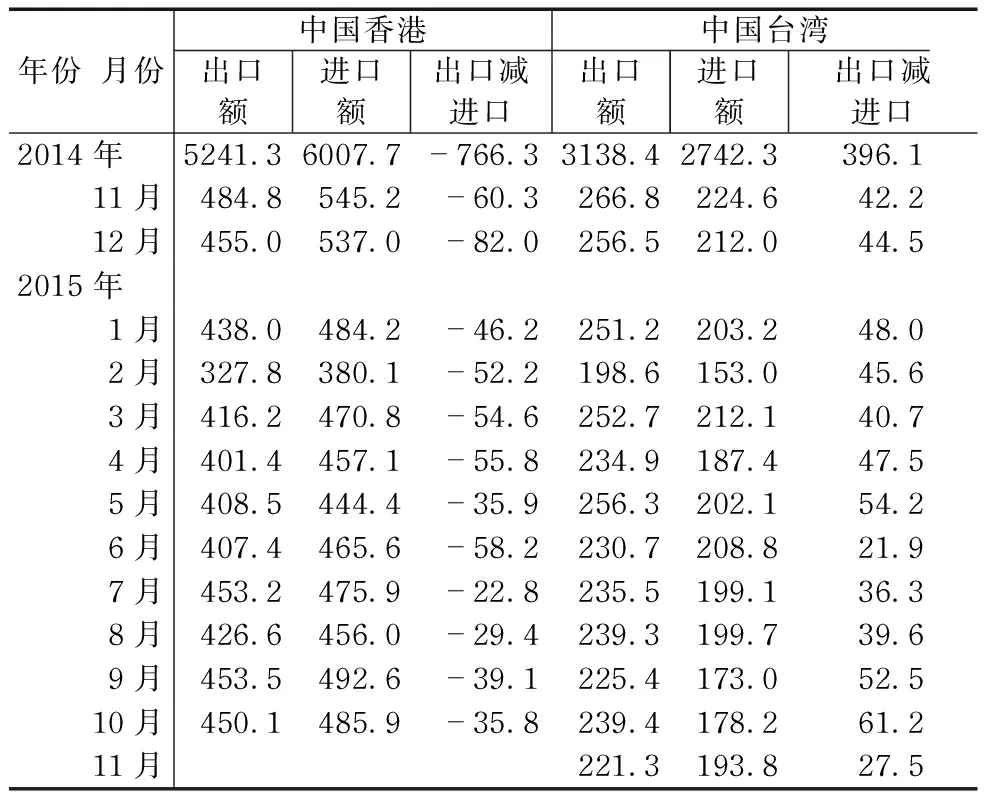

表33 進出口貿易 單位:億美元

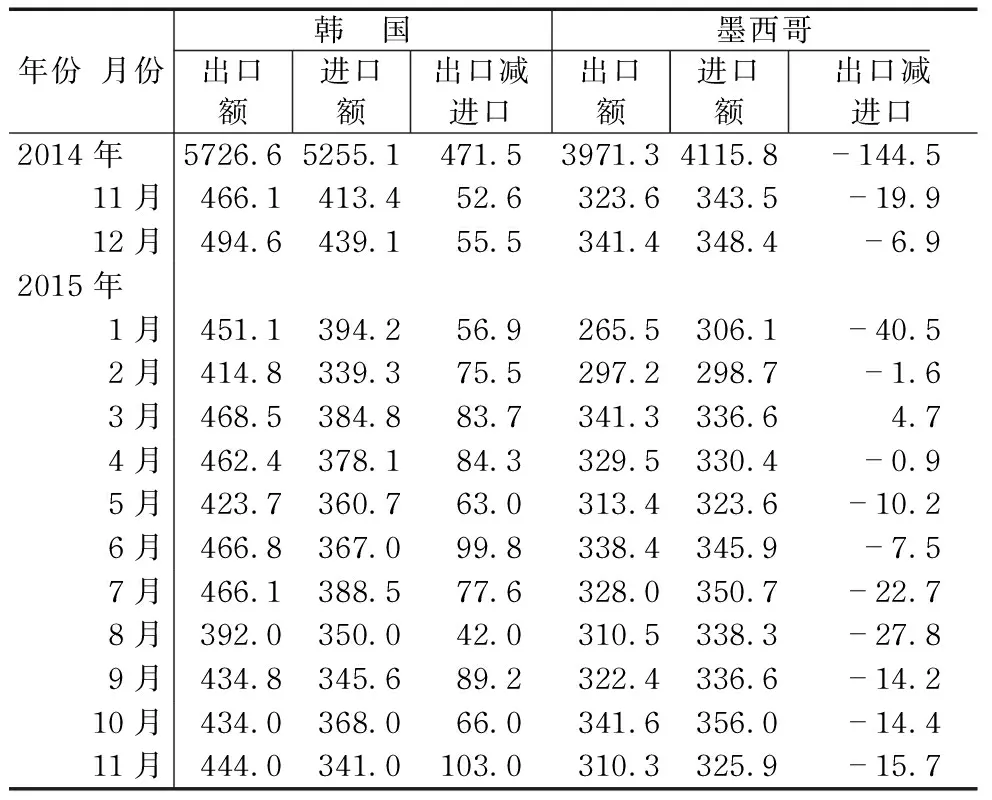

表34 進出口貿易 單位:億美元

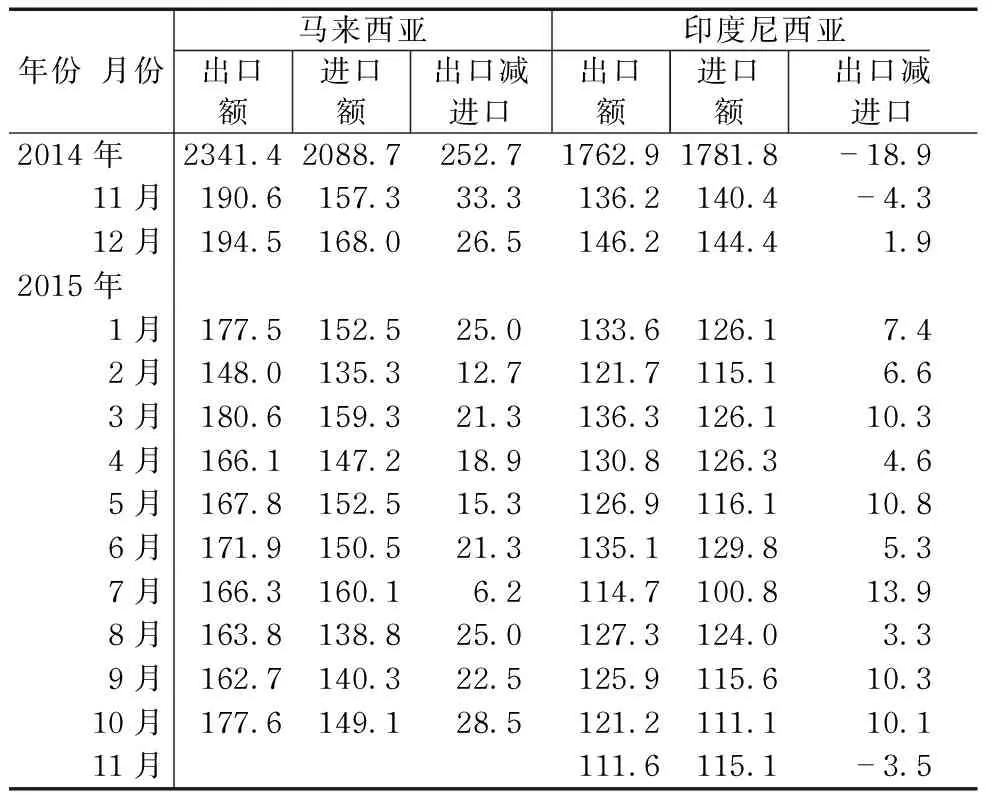

表35 進出口貿易 單位:億美元

表36 進出口貿易 單位:億美元

資料來源:各經濟體官方統計網站(表27~表36)。

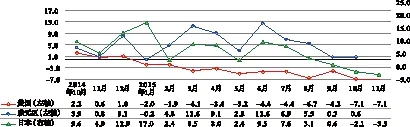

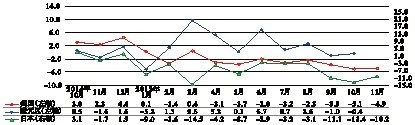

六、三大經濟體指標對比圖

圖1 三大經濟體GDP環比增長率(%) 注:美國為環比折年率增長率。

圖2 三大經濟體失業率變動(%)

圖3 三大經濟體出口額同比增長率(%)

圖4 三大經濟體進口額同比增長率(%) 數據來源:各經濟體官方統計網站(圖1~圖4)。

責任編輯:陳璇璇

S

(1) The Analysis of World Economy Trend in 2015 and Outlook on 2016

Chen Wenling Yan Shaojun

From 2015 to 2016, the world economic recovery is still slow, still in the slow growth of the “new normal.” Economy, politics and diplomacy under profound changes intertwined, and the world still stayed in the periods of turbulence, transition, change and adjustment. World Economy performed as “three lows” and the “three imbalances”, the major economies has obvious differentiations, macroeconomic policy game including currency, finance and trade between the major powers had become an important variable affecting world economic growth. The uncertainty of world economic growth increased. This requires us to grasp the development trend of the world economy and China’s economy, and implement a better opening-up strategy to address current challenges and fight for a better future, and strive for greater national interests in the stage of international cooperation and competition.

(2)Great Achievements of China in the period of the 12th Five Year Plan

Lin Zhaomu

During the period of the 12th Five Year Plan, facing the complex domestic and international environment, our Party has led people of all nationalities to make great achievements in economic, political, military, cultural and other aspects, which had laid a solid foundation for building a well-off society and had significant and far-reaching significance for the realization of two “one-hundred-year” goals.

(3)Sovereign Wealth Funds as International Institutional Investors: a Reevaluation (2008-2013 Survey)

Meng Chen, Jiang Chunyang

This paper provides a clear definition of Sovereign Wealth funds (SWFs) that differentiates them from similar institutions. It adds to the analysis of SWF behavior by using the lens of the theory of the multinational enterprise. A comprehensive survey of the international investment behavior of SWFs is undertaken that shows the funds to be largely conservative in their investment policies and non-strategic in investment approaches. Policies towards SWF are recommended that take account of their particular characteristics but are neutral with regard to their international investment behavior.

(4)Analysis and Outlook of Global Services Situation

Wang Xiaohong,Li Yongjian

In recent years, affected by the slow world economic recovery at sluggish growth, the global services industry has maintained steady low growth, extremely with uneven levels of development; cross-border investment keeps steady with a slight decrease, but still holding the dominant position; global trade in services remain robust in low growth, still better than the overall growth in world trade; policy innovation accelerates with the Internet becoming the main force. At the same time, the new trends will emerge in these ways: the development of Internet driving the global services industry into continuous innovation, Internet banking providing new impetus and a new model for the financial industry, crowdsourcing model becoming the new engine for growth in the service outsourcing industry, the intelligent manufacturing becoming the new trend in manufacturing Servitization, sharing economy becoming a new model of service development, big data and e-commerce and other new industry maintaining strong growth momentum. In 2015-2016 service industry will make a flat and low increase with about 3.2% to 3.5%, its proportion occupying about 70% in the whole GDP.

(5)Impelling RMB Internationalization with a New Round of Capital Account Opening

Ye Zhendong

After the international financial crisis, the voice of the international monetary system reform brings important strategic opportunities for the RMB internationalization. China is to build a comprehensive new system of open economy, with the efforts from all aspects of economic, financial, institutional and other rules, in order to seek international status with its matched power. With China’s “One Belt One Road” strategy gaining widespread and profound influence in the international community, the internationalization of RMB is expected to accelerate in the future. This paper analyzes the implications of RMB internationalization, determinants, benefits and risks. With a comprehensive of domestic and international research, based on the review of China’s capital account liberalization, it pointed out that a low degree of openness of the capital account is currently the most important factor to limit the internationalization of RMB, and analyzes the current situation of subitems of capital projects. In order to promote the internationalization of the RMB, we propose accelerating a new round of capital account liberalization, and properly handling the “three questions”, focusing on broadening RMB circulation channels to promote the construction of RMB securities markets, activate two-way direct investment, and improve the relevant supporting reform measures.

(6)Current Situation of China’s utilization of foreign investment in the 12thFive-year Plan period and strategic choice in the 13thFive-year Plan Period

Li Rui

In the 12thFive-year plan period, the world is in slow and difficult recovery after the international financial crisis, while FDI is also in fluctuated state. China’s FDI scale has been in sustainable development, industrial structure of utilization of foreign capital has been further improved, and regional distribution imbalance has been eased. With the continuous adjustment of state policies in utilization of foreign capital, China’s FDI scale, quality and efficiency has been continuously improving, thus China has become the largest Destination Country of FDI. Meanwhile, China’s utilization of foreign investment remains rising costs, uneven distribution and low efficiency. In “Thirteenth Five-year” period, foreign industrial layout is to be optimized for pushing up the value chain to the high-end; regional distribution of foreign investment shall be optimized for promoting balanced regional development; global high-end production factors gathering capacity is to be improved in enhancing innovation capacity; and a sound investment environment shall be created for encouraging investment liberalization facilitation.

(7)Thinking on the Current China’s Economy

Li Luoli

China’s current economic downturn is so clear that we need to consider more on its long-term development of the situation and the fact that the nature of serious consideration. Although the economy into some difficulties, but difficulties just develop it, not a crisis but not collapse. Current issue fundamentally beneficial long-term sustainable development, the key historical periods because the Chinese economy has been the need to transition. The current economic downturn phenomenon is bound to have and implement restructuring faced, the key is the correct solution. Observation of a country’s economic growth rate is reasonable, mainly to see its growth rate can meet the employment rate. Only the traditional economic indicators to determine trends and long-term development of the real economy, is no longer accurate and objective, the need for new indicators to analyze and research on new economic form. Analysis of the investment rate and consumption rate is reasonable, you must look at the nature of the phenomenon in depth. China’s current economy continues to improve, mostly with great innovation ability and enthusiasm. Various information data on e-commerce, to a certain extent can be an important indicator to observe today’s new economic form.

(8)Reform of the Housing Accumulation Fund System under the “New Normal”Situation

Cao Wenlian, Deng Zhihua, Fang Zheng

China’s development into the new normal, housing provident fund system is difficult and time. To promote its reform, we must fully understand the “quasi public goods” nature of the housing provident fund, and create a new type of housing provident fund system with Chinese characteristics. Should base on the national conditions, pay close attention to the justice, broaden coverage, to accelerate the formation of its redistribution function of the provident fund accumulation system; the focus for the low-income groups, a moderate expansion of fund use, accelerate the construction of housing policy financial system; to promote public information, improve the regulatory system, the establishment of rights and responsibilities clear, clean and efficient fund management system; to properly resolve the issues left over from history and the conflicting interests of the parties, carefully designed, implemented step by step, and strive to achieve provident fund system transformation in 3-5 years.

Editor:Guo Zhouming