Freight rate hedging with futures strategy

KASSEMBE Eliamin,ZHAO Gang

(School of Transport& Communications,Shanghai Maritime Univ.,Shanghai 201306,China)

0 Introduction

Shipping is a risky business for both shipowners and cargo shippers.It is risky because the freight market thereof is unpredictable and highly volatile.Since shipping business is one of the capital intensive investments,it implies that the risks thereof have a greater impact on the business investors.As a matter of fact,these risks are potentially hidden in time and magnitude of revenue.The shipping industry has witnessed a tremendous change in the last two decades.Ships have increased in sizes profoundly.The expansion of scale has always been prompted by the advantages from the economies of scale.The consequences of the change is that the international trade volume has grown enormously[1]and business competition in port enterprises and shipping companies has strengthened,too.However,the typical behavior of the shipping industry has remained the same,characterized by its highly unstable freight rates,seasonality,strong business cycles and capital intensiveness.

The obvious impact of shipping risks on shipowners,charterers and shippers can often make a difference that whether they are able to stay in business or not.Thus,it is necessary to be aware of the market risks involved and risk management strategies in order to rescue investors and the industry.The objective of this paper is to answer the following three questions:(1)How can shipping freight rate risks be neutralized?(2)Is futures derivative a convenient strategy for freight rate hedging?(3)How can shipping investors minimize their futures hedging costs?

1 Methodology

To understand the hedging,it is important to understand the concept of basis risk and price risk.This is because the essence of hedging involves an exchange of price risk for basis risk.What is basis risk?Practically,hedging is hardly straightforward because:(1)the asset whose price is to be hedged may not be exactly the same as the asset underlying the futures contract;(2)the hedger may be uncertain of the exact date the asset will be sold or bought;(3)the hedger may require the futures contract to be closed out before its delivery time/month.These problems give rise to what is termed as“basis risk”.[2]The basis risk emanates from changes of the derivative prices in relation to the corresponding spot prices.It is uncertain whether the spot-futures spread will widen or narrow in the time that a hedge position is implemented and liquidated.[3]Actually,the basis B(t,T)in a hedging situation can be simply defined as the difference between the spot and futures prices.[4]It can be expressed as

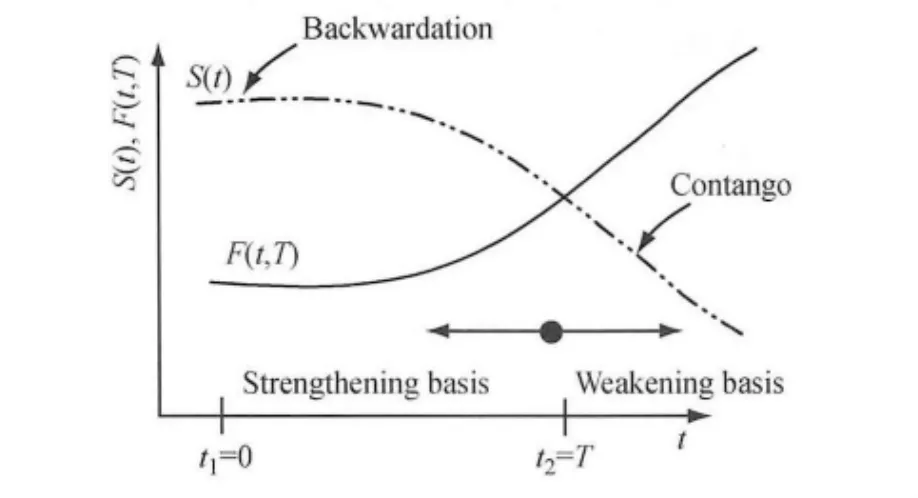

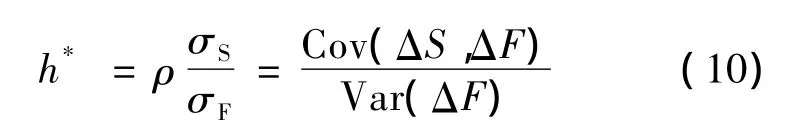

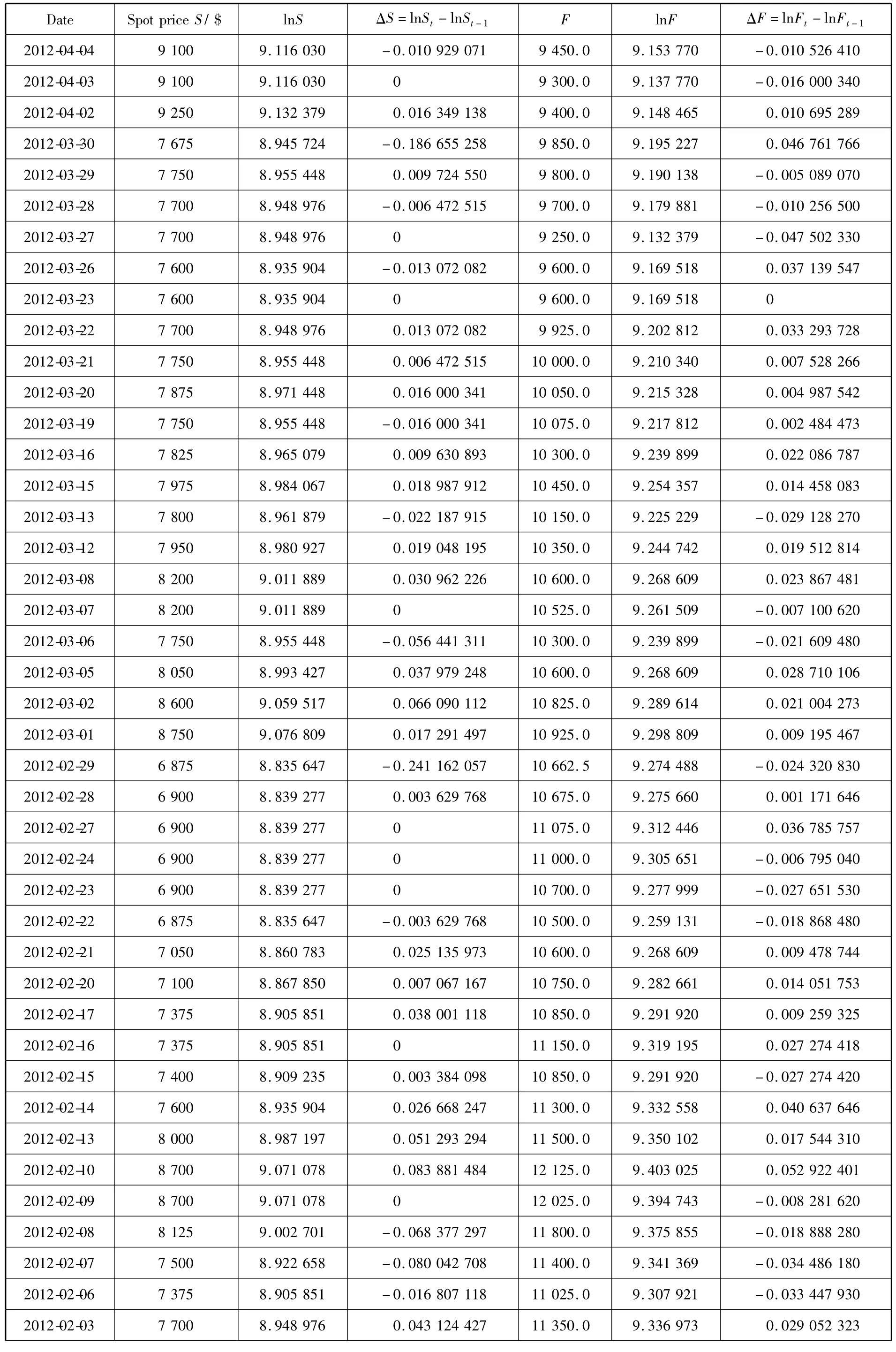

B(t,T)=S(t)- F(t,T) (1)where B(t,T)is the basis at time t,S(t)is the spot price at time t,and F(t,T)is the futures price at time t.The basis converges to zero since F(t,T)=S(t)as t→T,as shown in Fig.1.The basis changes as the factors affecting spot and/or futures markets change.[4]When the basis is larger,spot and futures prices are more divergent from each other,indicating a lack or ineffectiveness of arbitrage activities.As a consequence,both markets become more volatile.[5]

Fig.1 Variation of basis with time

The variation of basis with time is simply portrayed in Fig.1.If we consider t2as point zero(convergence point),the opposite direction will be negative.In the negative direction the spot price S(t)increases more quickly than the future price F(t,T),and therefore the basis B(t,T)increases.HULL[2]and KAVUSSANOS and VISVIKIS[3]considered this as strengthening of basis.Nevertheless,KAVUSSANOS and VISVIKIS[3]described this as a narrowing basis because the absolute difference between spot and futures prices becomes smaller,and subsequently becomes zero when spot and futures prices converge.

Additionally,in Fig.1,the spot prices are portrayed to be higher than derivative prices, i.e.,S(t)> F(t,T),which implies that the basis B(t,T)is positive.Such state of affairs is called a market in backwardation(futures price lower than spot price).After the convergence point,the spot prices become lower than the derivative prices,and then the basis B(t,T)is negative.This kind of arrangement is called a market in contango condition.[2]

The concept of basis is vital and informative in hedging with the futures strategy.Likewise,it is possible to trade with basis because basis can be used to determine the expected price.[4]Since basis B(t,T)is fairly stable and predictable,it is possible to use the historical basis information to calculate anticipated buying and selling prices.Initially we can consider the situation of a hedger who knows that the asset will be sold at time t2and takes a short futures position at time t1.At time t2the hedger shall receive S(T)from selling the asset plus the cash flow,F(0,T)- F(t,T),due to marking to market.This is shown as

S(T)=F(0,T)+S(t)- F(t,T) (2)The equation above implies that the price realized for the asset S(T)is regarded as the expected price E(S(T))and the profit B(t,T)as expected basis E(B(t,T)),which is given as a general expression

E(S(T))=F(0,T)+E(B(t,T)) (3)The price F(0,T)is known,and the term E(B(t,T))represents a hedging risk due to the uncertainty associated with B(t,T)and is known as basis risk.The risk involved in the hedging position is concerned with the unknown cash flow and profit.Therefore,by hedging,a company ensures that the price that will be paid(or received)for the asset is S(T),which is regarded as the expected price E(S(T)).Also,basis risk increases as the time difference between the hedge expiration and the delivery month increases.[2]

Basis trading can be done when the premium is too high(sell the basis)by going short on spot and long on futures,and when the premium is too low(buy the basis)by going long on spot and short on futures.

2 Futures hedge ratio modeling

LIEN and YANG[5]admitted that the na?ve(oneto-one)hedge strategy does not help reduce risk effectively because the standard deviation of the basis is larger than that of spot futures returns,i.e.,σF> σS.To understand the fact σF> σS,we need to consider combination investments in the spot market and the futures market to form a portfolio that will reduce fluctuations of values.[6]

Suppose the firm sells a fraction h(the hedge ratio)of its future production at the futures price F(t,T).This is to say,we expect to sell Naunits of an asset at t2=T and choose to hedge at t1=0 by shorting futures contracts on NFunits of a similar asset.If we consider that Na≠NFand Na> NF,the hedge ratio h<1 exists and is defined as the number of futures contract divided by the number of spot contract.[7]More conveniently,h is the ratio of the size of the futures position to the size of the exposure,[8]given as

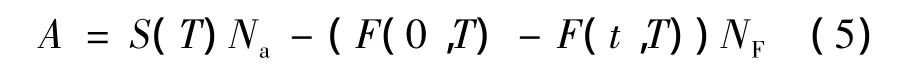

If the total amount A is realized for the asset when the profit or loss on the hedge is taken into account,then

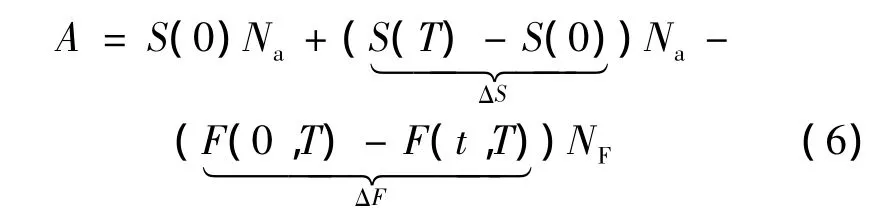

Inserting S(0),we have

where S(0)and S(T)are the asset prices at t1and t2,and F(0,T)and F(t,T)are the futures prices at t1and t2.Then A can be modified to

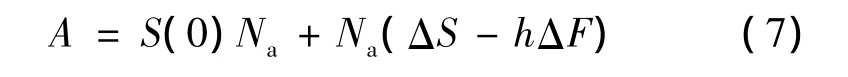

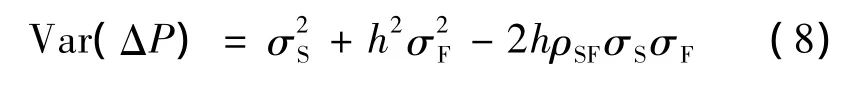

where ΔS is the natural logarithmic change of the spot position between t1and t2;ΔF is the natural logarithmic change of the derivative position between t1and t2;h is the proportion of the portfolio held in derivatives contract(the hedge ratio).S(0)and Naare known at t1.The expression ΔS - hΔF refers to a special basis[4],and it can be regarded as the change in portfolio ΔP of spot and futures positions between t1and t2.The variance of A can be minimized when the variance of the basis ΔP= ΔS - hΔF is minimized.The variance of ΔP is

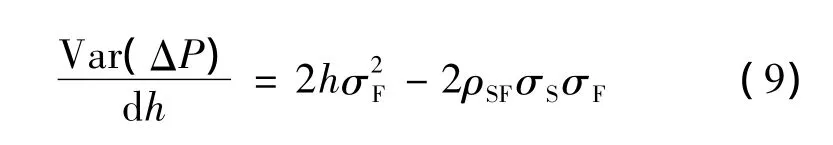

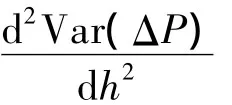

where ρSFis the correlation coefficient between the spot and futures prices,and σSσFare the standard deviations.The hedger must choose the value of h that minimizes the variance of his hedged portfolio.This can be done by minimizing Eq.(8)with respect to h.The outcome of this process will be a Minimum Variance Hedge Ratio(MVHR),achievable from min(Var(ΔP)).If σS,σFand ρSFare considered as constants,we can take derivative of Eq.(8)with respect to h as

This ratio can be determined empirically and it varies with data and time.A special case known as the na?ve hedge is achieved when ρ=1 and σF= σS,making the hedge ratio h*=1.However,the problem with na?ve hedge is that a company cannot minimize its risks by a hedge ratio of 1.In this case the futures price mirrors the spot price perfectly and is the so-called na?ve hedging strategy.[5]Nevertheless,h*is the optimal ratio,which is also known as the conventional MVHR.[9]

It is obvious that when we choose to use MVHR,we certainly choose to avoid the excess value he.The use of MVHR in futures hedge gives the advantage to avoid wastage of resources for the principal that emanates from the overhedging.The overhedge position is the difference between the size of exposure and the size of the futures contract quantifiable by Eq.(11):

Since the overhedge concept explains the degree of how much resources are wasted through hedging,it can be expressed as an overhedge ratio given by

By substituting hein Eq.(11),we can obtain a simplified expression Nahe,which can be used to calculate the overhedge position being hedged.

3 Data description for case study

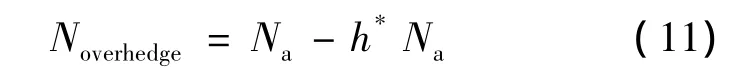

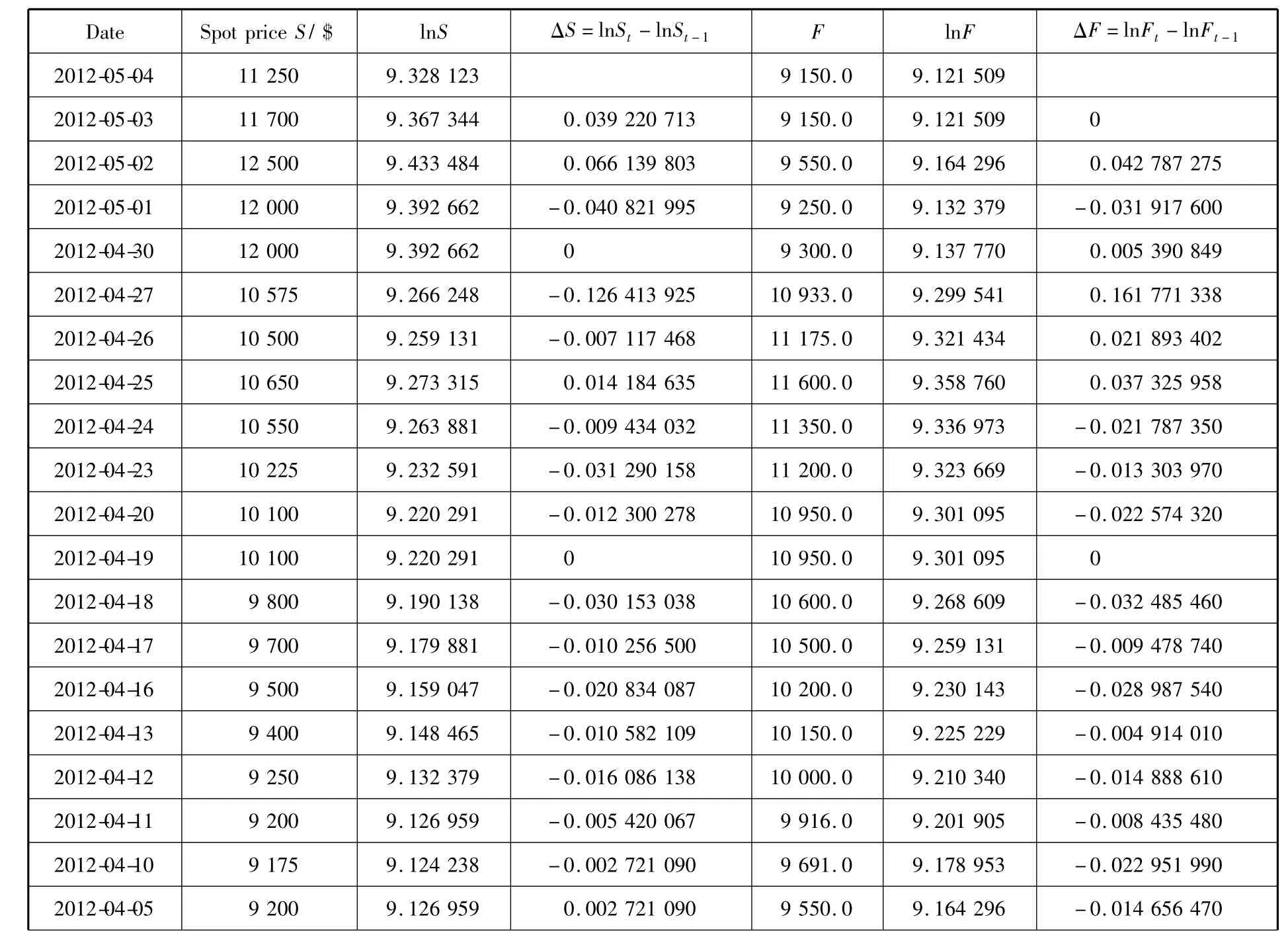

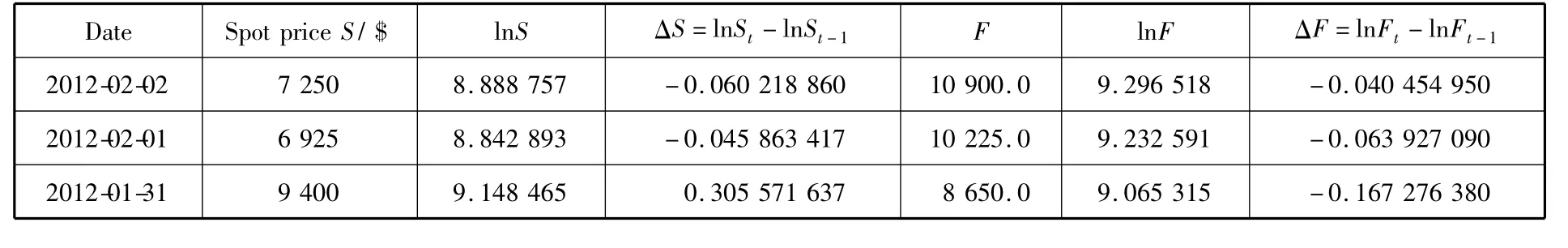

The data set consists of the three-month daily spot(S)and futures(F)prices for the route P2A of the FFA(Skaw-Gibraltar to Taiwan(China)-Japan)from January 31 to May 4 of 2012.Table 1 shows a onemonth period data of both futures price and spot price.The natural logarithmic price changes of spot(ΔS)and futures(ΔF)are calculated and included in Table 1.

Table 1 Daily futures and spot prices for route P2A(2012-01-31 to 2012-05-04)

Table 1(Continued)

Table 1(Continued)

4 Analysis and discussion

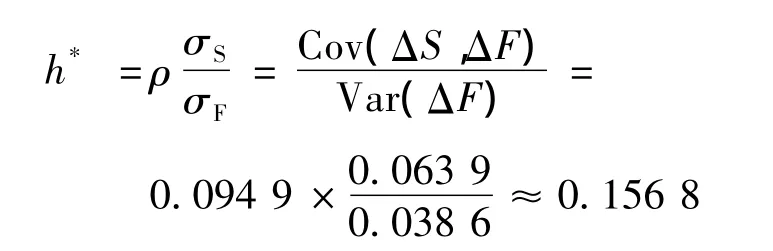

The data in Table 1 and the MS Excel software are used to calculate the standard deviations of ΔS(σS)and ΔF(σF)and the correlation coefficient(ρSF)between ΔS and ΔF,and their results are σS=0.0639,σF=0.0386,and ρSF=0.0949.These numbers are used to calculate the optimal hedge ratio as follows:

The estimated hedge ratio h*of 0.1568 implies that the shipowner should sell$0.1568 worth of futures contracts for each US$of freight rate income.Since the optimal MVHR is calculated to be h*=0.1568,it implies that this is a value that is 15.7%of the value of the conventional hedge ratio 1.It indicates that only 15.7%of the physical position should be initiated in futures contracts to obtain full hedge.That is,if the exposure to the freight market is$1000000,a paper trade of$156800 rather than a futures position of$1000000 is sufficient to cover the risk exposure fully.

4.1 Calculation of overhedge ratio and value

Since he=1-h*,the overhedge ratio he=1-0.1568=0.8432.Thus,the overhedge value

4.2 Basis variation and hedge decision

The overhedge amount of$843200 that is about 84%of the whole physical position is clearly wastage of resources for the principal,and opens for speculative trade.The shipowners or charterers can choose to avoid the overhedge position if the decision to hedge is taken.This amount can be avoided by the optimal hedge ratio that is also known as MVHR.

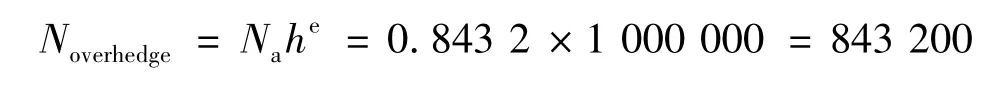

By inspecting the behavior of the basis over the whole period shown in Fig.2,the futures prices display a falling trend while spot prices display a rising trend.The convergence point is approximately on May 3,2012,the day S(t)=F(t,T)and t=T.The convergence point divides the market into two parts,the backwardation and the contango markets.The figure also shows that the backwardation market spreads out from time t=0 on January 31,2012.During this period(backwardation market)the shipowner does not face any freight risk and therefore may choose not to hedge his position.However,the case is different for the charterers as there are some noteworthy risks in the backwardation market.Therefore,it may be more sensible for the charters to hedge their positions by buying freight futures contracts to hedge from the potential rise in the freight market.Conversely,from May 3,2012,the basis will be in the contango market and the shipowner will be required to hedge their commission income in the falling freight rates by selling freight futures.

Fig.2 Behavior of basis with time

5 Conclusion

The analysis in this paper shows that the na?ve futures involves some excess amount in the hedge position.The use of the optimal hedge ratio(also known as MVHR)in both futures and forward hedging is indispensable.It provides the possibility to avoid the excessive amount known as“overhedging”,a representative of a speculative position for the shipowner.For that reason the overhedge is a wastage of resources for the shipowner.

The value of h*of the physical position may be initiated in futures contracts to obtain a full hedge.This strategy can cushion the investor’s discomfort and can compensate for risks involved in decisions involving sums of money.

[1]WTO.Trade growth to ease in 2011 but despite 2010 record surge,crisis hangover persists[S].Press/628,Apr 7,2011.

[2]HULL J C.Options,futures,and other derivatives[M].London:Pearson Education,2009.

[3]KAVUSSANOS M G,VISVIKIS I.Derivatives and risk management in shipping[M].London:Witherby Publishing Group,2006.

[4]CAPINSKI M,ZASTAWNIAK T.Mathematics for finance:an introduction to financial engineering[M].London,Berlin,Heidelberg:Springer,2003.

[5]LIEN D,YANG L.Hedging with Chinese metal futures[J].Global Finance J,2008(19):123-138.

[6]CHEN S,LEE C,SHRETHA K.Futures hedge ratios:a review[J].Q Rev Econ & Finance,2003(43):433-465.

[7]CHI Guotai,YANG Zhongyuan.Optimal model of strip-and-roll hedge based on the min-variance.Syst Eng:Theory & Practice,2009,29(12):83-91.

[8]HULL J C.Risk management and financial institutions[M].London:Pearson Education,2009.

[9]LIEN D,SHRETHA K.Hedging effectiveness comparisons:a note[J].Int Rev Econ & Finance,2008,17(3):391-396.