委托代理沖突下的企業投融資決策想

委托代理沖突下的企業投融資決策楊招軍 夏鑫 甘柳

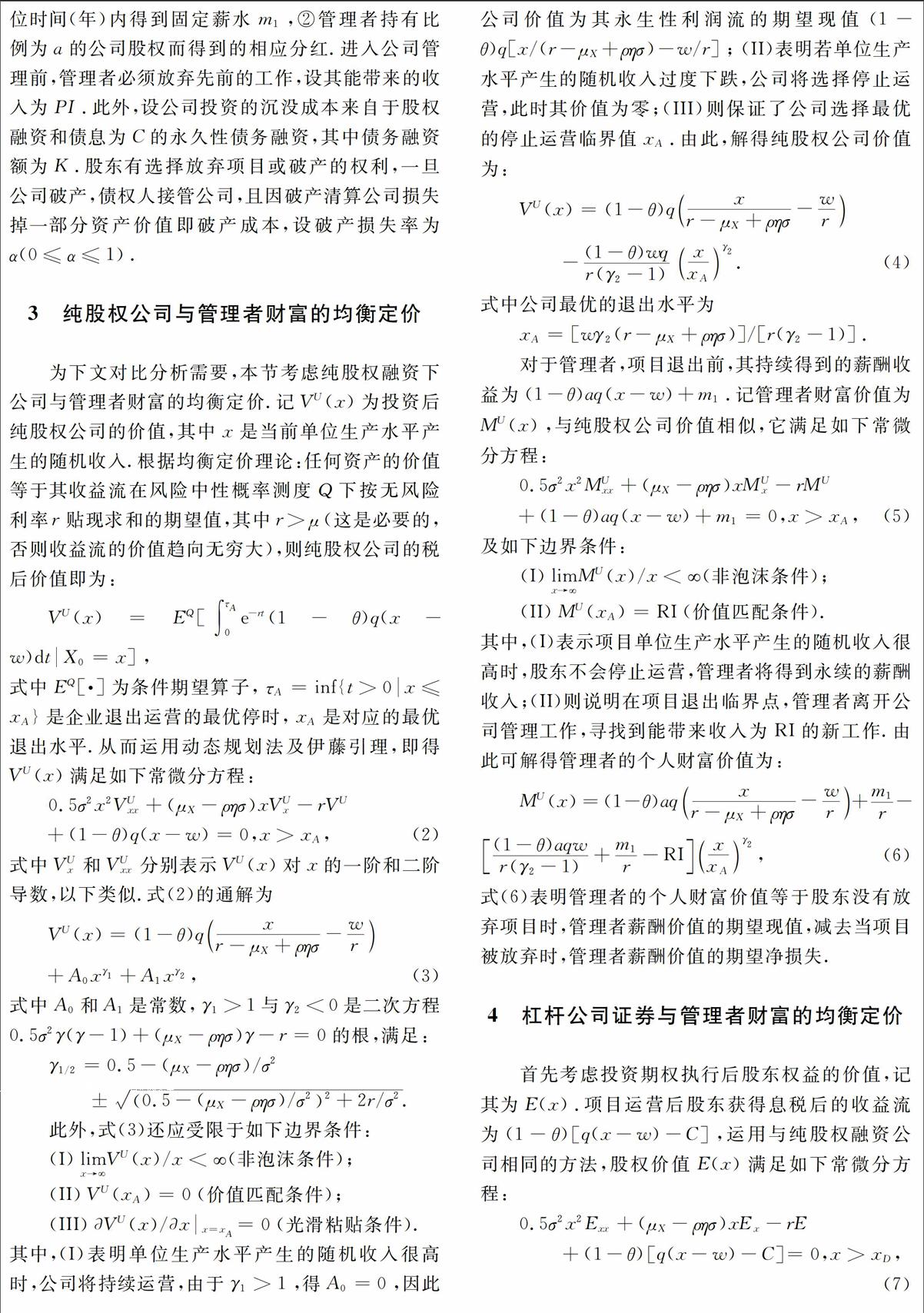

摘 要 采用實物期權與均衡定價理論,研究委托-代理沖突下的企業投融資決策問題.考慮管理者擁有企業投融資決策權時,其如何同時選擇投資時機、投資規模及資本結構.分析了管理者持股與項目風險(不確定性)對企業非效率投融資的影響.數值分析表明:給定資本結構下,杠桿企業管理者決策的投資時機與投資規模變化呈現出負相關;對比于純股權融資企業,杠桿企業管理者加速了投資期權的執行并增大了投資規模;財務杠桿率是管理者持股比例的U形函數,且管理者持股比例的增大,會加速投資期權的執行、增大投資規模與債務融資規模,并降低代理成本;項目風險的增大會導致企業投資時機、投資規模、債務融資規模和代理成本增大及財務杠桿率降低.

關鍵詞 委托代理;投資時機;投資規模;資本結構

中圖分類號 F830.59 文獻標識碼 A

Corporate Investment and Financing Decisions under

PrincipalAgent Conflict

YANG Zhaojun, XIA Xin, GAN Liu

(College of Finance and Statistics, Hunan University, Changsha, Hunan 410079, China)

Abstract This paper studied corporate investment and financing decisions under principalagent conflict by means of real options approach and equilibrium pricing theory. We considered the investment timing, investment capacity and capital structure choice simultaneously when corporate investment and financing decisions were made by a selfinterested manager. We analyzed how the manager's ownership stake and project risk affected inefficient investment and financing decisions. The numerical results show that the investment timing and investment capacity of leveraged firm are negatively related to each other under the given capital structure; The manager will accelerate the investment and increase the investment capacity, compared with an unlevered firm; Leverage ratio exhibits a Ushaped pattern against the manager's ownership stake; A greater manager's ownership stake makes investment earlier and results in an increase in investment capacity and debt financing capacity, and a decrease in agency costs of debt; An increase in project risk delays investment and leads to an increase in investment capacity and debt financing capacity, a sharp increase in agency costs of debt, and a decrease in leverage ratio.

Key words principalagent; investment timing; investment capacity; capital structure

1 引 言

投融資決策是公司理財的重要內容,其科學性直接關系到公司發展和經營的持續性.因此,公司投融資決策理論和應用問題一直是公司金融的研究熱點.其中,以Dixit and Pindyck(1994)[1]為代表,實物期權理論已成為了探究公司不可逆投資策略的標準方法.然而,隨后基于標準的實物期權模型對公司決策的擴展研究多集中在無委托-代理沖突下最優投資時機和最優融資策略(資本結構)的選擇上,如Mauer and Triantis(1994)[2]與Mauer and Sarkar(2005)[3],著眼于最優投資規模的研究很少,尤其是考慮委托-代理沖突下同時選擇最優投資時機、最優投資規模及最優資本結構的問題.

實際中,公司投資規模的大小反映未來公司生產水平的高低,進而影響公司投資效益的好壞.有鑒于此,一些文獻在實物期權模型中融入公司選擇投資規模的靈活性,從而拓展了標準的實物期權方法.例如,Barllan and Strange(2000)[4]和Barllan and Agne(2002)[5]比較了一次性投資、增量投資和可逆性投資對最優投資時機和最優投資規模的影響;Sudipto(2011)[6]基于文獻[4]融入債務融資,并假定管理者和整個公司利益一致,同時考慮了最優投資時機、最優生產規模及最優資本結構的選擇問題.但現實中,管理者由于沒有擁有公司的所有權,他們的投融資決定往往都是追求個人財富價值最大化,而不是股東和整個公司利益,從而導致委托-代理沖突問題,對公司的投融資選擇造成不利的影響.