An analysis on the application of financial evaluation in stock investment decision teaching: Take Adelaide Brighton Limited as the research subject

【Abstract】It is indispensable but time-consuming process to collect information comprehensively to probe into the investment value. This essay aims to analyze the application of financial evaluation in stock investment decision teaching by illustrate the case study on a global trading company whether and when to hold the companys stock shares in the stock exchange. In this case study, the target company is focused on the Adelaide Brighton Limited (ABC) in Australia. The factors that are contributed to draw a final conclusion are including macro-economy, specific structure of its target market and the business performance of this company based on the financial statements issued by ABC. In the beginning, it introduces the environment and condition that the company faces. Then by taking advantage of ratio analysis, it takes effort to figure out the business performance and the potential growth opportunities and risks of the company development. In the end, it shares opinions on whether investors should purchase or sell ABCs shares as recommendation.

【Key words】financial evaluation; stock investment decision; investment value; Adelaide Brighton Limited

1. Introduction

It is indispensable but time-consuming process to collect information comprehensively to probe into the investment value. To get a better understanding of the application of financial evaluation in stock investment decision teaching, this paper analyzes the case study on a global trading company whether and when to hold the companys stock shares in the stock exchange. Adelaide Brighton Limited (ABC) is the research subject which is an Australia-base company fighting for its own development and success in the construction material industry. The history of this company can be dating back to 1882. The products are so various that it includes clinker, cement, lime, concrete and supplementary cementations materials all served for the residential construction in Australia and non-residential construction markets.

The strategy of ABC is aiming for vertical integration in the value chain. For a company which covers its business from the row material supply to the finished goods sales, it has significance in paying much attention to control and upgrade the process to keep a competitive position. Because of the demand for further development and expansion, it floated its stock shares to finance capital in the Australia stock exchange. Therefore, it is necessary for the wide public investors to make an evaluation of the company and determine whether to invest.

2. Macro-economical and market structural factor

Whenever and wherever, what is always a hot topic in the world cannot be out of energy and resource. With the shortage of the whole world resource, the price for that scarce resource is higher and higher. It is absolutely true that no one can say no to material resource if they want to get developed in the economic level. As Australia is a super country in source field, it is easy to safe that it must be profitable in the source related industry.

Although the global is hit by the financial crisis, the influence on economy varies from country to country. For this special period, there may be a problem in the market demand. But it must be a short term effect. It will definitely have a bright future based on the economic development principle (Norman, Frumkin. 2006).

Another important factor should be called attention is market structural. An effective and helpful market structure, without any doubt, can drive the success in the business performance, especially when the general macro-economical leaves much to be desired. Based on the products that the ABC operates in, the market can be segmented in that way. By concentrating on the specific market, it probably acquires more with the limited source. Aiming with small markets, it is easier to entry the market with less market research and labour cost to achieve an unexpected success (Hooley, Graham J. 2004).

3. Financial ratio analysis for the investment

The profitability capability is important for the ownership because it is closely related to whether they could turn their expected benefit into reality. And a favourable profitable sign will definitely attract investors. Without any doubt, it ensures a sound financial capability to fight for further development (Sharp, John. 1998).

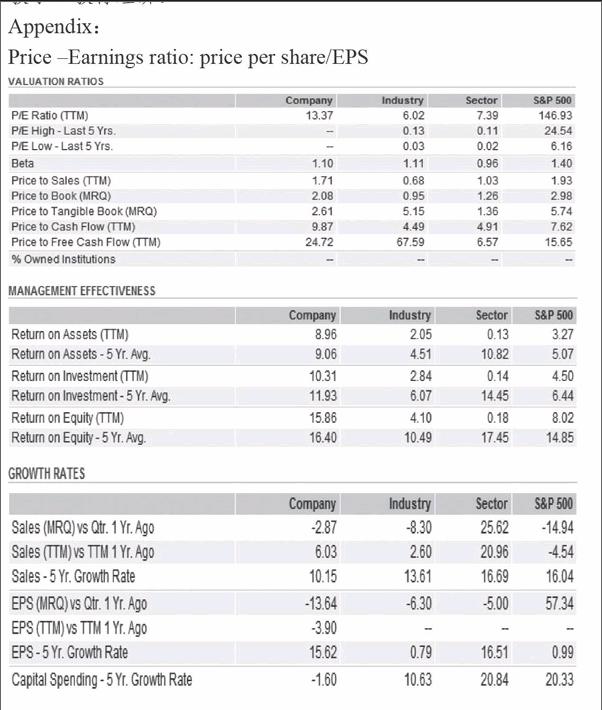

In the investment decision, Price –Earnings ratio is a useful ratio to measure whether a company is worth investing. The price per share presented in the stock exchange lies in the capability for creating profits and how bright the companys prospect is. The Price –Earnings ratio is just revealing the relationship between EPS and stock price per share. Comparing with the P/ E of the industry or other firms, the investor is able to take this index as reference to make a decision.

Generally speaking, a company with bright prospect will usually enjoy a P/E that is higher than average industry level. According to the information listed on REUTERS, the P/E ratio for the ABC in 2009 is 13.37 while the whole average industry level is just 6.02. There is no doubt that it takes absolutely advantage over other firms in this industry (Temple, Peter. 2002).

4. Evaluation of investment

4.1 Evaluation of growth opportunities and risks

When it comes to investment, it has to face two aspects of the target objective: opportunity and threat. How much reward the investors acquire means how many risks they have to bear. According to the information listed on REUTERS, the result of return on assets for the ABC leads an absolute advantage in this industry. The factor probably attracts many investors and cheers them up. It is true that all signs show an effective management and operation of the ABC. Due to the sound premises and prudent development strategy, the performance of the ABC is always outstanding comparing with others.

However, people cannot deny that the financial crisis depresses the global economy. The sales amount in 2009 leaves much to be expected comparing with the same corresponding period under the gloomy industry background. Therefore, the risk is mainly from the stagnant market if the global economy fails to recover in the near future. It means that there still is trouble in demand.

4.2 Evaluation of risk-reward estimations of the investment

It is widely acknowledge in investment that the relationship between risk and reward is in the same level. It means that no risk, no reward. What is the reward is the payment that investor takes the risks. It has no difference in the decision on the ABC investment.

On one hand, excellent business performance of the ABC in the past years is likely to build much confidence in investors and it makes them feel less blind. On the other hand, the dismal macro-environment will falter many investors. Besides, with the appreciation of the Australia dollar, the export probably become more difficult and sales condition may falls into deeper trouble (Gildersleeve, Rich. 1999).

5. Targets for returns and future checkpoints

From the historical data, the expected targets for returns can be summarized from the following aspects: return on assets, return on equity and return on investment. All of them are pretty higher than the industry level in the corresponding period. The ratio may be more cheerful as the global economy is recovering. In a short time, the investors have to pay much attention to the sales performance. It is a sensitive sector but the main drive to push the profit.

6. Recommendations and Conclusions

Based on the above analysis, the following part will draw a conclusion as recommendation for investors to make a decision. Under the financial crisis shadow, the whole economy appears to be pathetic and hopeless sign. It has an influence on every country to different degree. As the material products are mainly used in the infrastructure construction, the business performance of the ABC must be affected by the fact. The share price has been tepid in the recent days.

However, it should be a transitory moment and it will reach a normal level in the history finally. So there may be two kinds of steps for different investor. For those investors whose stock shares were purchased at a high price, it is inappropriate to sell them out at such a low point but they should wait for the rebound patiently. For those fresh investors, it seems to be an opportunity to carry on a strategy investment if they hold enough confidence in ABCs future. It seems to be impossible to fall lower that the present price from the historical data. They had better seize the chance to purchase the shares at an optimum quantity. With the recovery of economy, the price must be spouted (Vause, Bob. 2009).

Generally speaking, Adelaide Brighton Limited is a company with a bright future based on the statements carried out above. The main business is focused on the material market. In order to make the business operation more effective and successful, it is divided into several segmented markets according to its products. It shows great potential as the whole world resource is less and less. With superb business chain management and prudent development strategy, it enjoys its prosperity with outstanding performance. As an investor, it is unwise to ignore this hopeful stock. Although the whole worlds economy is in recession, it is still able to maintain a not bad operation. With the market rebounding, the ABC will definitely embrace further prosperity.

References:

[1]Hooley,Graham J.,(2004),Marketing strategy and competitive positioning,Financial Times Prentice Hall,Harlow.

[2]Gildersleeve,Rich,(1999),Winning business:how to use financial analysis and benchmarks to outscore your competition,Gulf Pub.Co.,Houston.

[3]Norman,Frumkin,(2006),Guide to economic indicators,M.E.Sharpe,Armonk.

[4]Sharp,John,(1998),Profitability,McMillan College,Warragul.

[5]Temple,Peter,(2002),The 33 key ratios that every investor should know,Wiley,Singapore.

[6]Vause,Bob,(2009),Guide to analysing companies,Bloomberg Press,New York.

作者簡介:黃珊(1984-),女,漢族,陜西勉縣人,澳大利亞悉尼大學會計學碩士畢業,講師,研究方向:商務英語教學、教育經濟。

Appendix:

Price –Earnings ratio: price per share/EPS

- 校園英語·中旬的其它文章

- “互聯網+”背景下公共英語教學模式探究

- 《教學下的二語習得導論》介評

- The Application of Scaffolding Theory in College English Reading Teaching

- Designing the Activity—based Online English Course—A Perspective from Input and Output Hypothesis

- 西部開發下新疆的翻譯市場以及對“教育的訴求”

- A Psychoanalytical Approach to Nathaniel Hawthorne’s “Young Goodman Brown”