Analysis on the Attitude of the Bank of China Towards SMES Loans

Shen Lei

(Shanghai Lingang Songjiang Science and Technology City,Shanghai 201612)

Abstract:China's economy has entered a stage of rapid development in recent years,apart from the state-owned enterprises,many SMEs have become an important component of the national economy of China,and have been greatly supported and funded by the national finance,however,under the influence of private economy,SMEs are facing severe pressure.

Key words:SMES(small and medium-sized enterprises);Banks;Financing loans

According to the national economic census data,at the end of 2018,there were 18.07 million small,medium-sized enterprises in China,an increase of 115%①than 2013,accounting for 99.8% of all-scale enterprises (hereinafter referred to as all enterprises),0.1 percentage point higher than 2013.

As government data show,the proportion of private small,medium-sized enterprises in the national economy is high,but the actual number of enterprises is small,and the level of standardized operation is low,among which there are a number of enterprises with low credit rating,and there are poor operation level of enterprises every year.

SMEs is in the initial stage,problems such as insufficient normative operation and financial management,and the lack of selfguaranteed and pledged assessed assets are common among them,which makes it extremely difficult for SMEs to apply for financing loans from banks.

Due to the global pandemic,In 2020,in the face of prominent problems such as tight cash flow and sharp decline of overseas trade orders,SMEs are in urgent need to obtain loans from banks to ensure the cash flow needed for daily operation.

In terms of of banks,as a financial institution responsible for its own profits and losses,each project needs to be lucrative.For the financing and loan needs of SMEs,based on their own risk control,the audit requirements are bound to be very strict,minimizing the probability of overdue failure to repay bad debts.

This report will analyze the structure of China's banking industry,the situation of SMEs in China,and attitude of the Bank of China towards loans to SMEs.

1 Overview of SMEs in China

SMEs have created a large number of employment opportunities and become the main source of employment.By the end of 2018,SMEs have employed 233,004 million people,an increase of 5.5%from the end of 2013,accounting for 79.4 percent of all employment,0.1 percentage point higher than 2013.The total owned assets reached 402.6 trillion yuan,accounting for 77.1% of the total enterprise assets;the annual operating income reached 188.2 trillion yuan,accounting for 68.2% of the annual operating income of all enterprises.Among them,there are 15,265 million private enterprises,SMEs,up 166.9%over the end of 2013,accounting for 84.4% of all enterprises,and 16.5 percentage points higher than 2013.

SMEs n China are mainly private enterprises,private SMEs in entity enterprises accounted for more than 90%,driving more than 80% of urban employment,contributed more than 70% of technological innovation,GDP contribution reached more than 60%,tax contribution to more than 50%②。

Loans from SMEs accounted for about 40%.The outstanding balance of small business loans reached 43.1 trillion yuan ($6.1 trillion) in 2019,with a five-year growth rate of 14.3% from 2014 to 2019.It is expected to reach 76.6 trillion yuan in 2024,with a fiveyear annual growth rate of 12.2%.Total demand for small business loans in 2019 was estimated as 89.7 trillion yuan ($12.7 trillion).In 2019,China's unmet small business loans accounted for 52% (or 46.6 trillion yuan),which remained unmet.Such unmet demand is expected to reach 50.0 trillion yuan by 2024.(ZERO ONE THINK TANK.2020)

Half of the annual turnover of SMEs is less than one million yuan,the number of total assets is generally small,nearly 70% of the total assets are less than 3 million yuan,80% employees;nearly half of the SMEs are involved with the traditional entity industries such as wholesale and retail,manufacturing,construction and real estate,most entrepreneurs are beyond the 3-year threshold.Due to the small scale of SMEs,the majority of the capital is used to maintain business operation or expand the business scale,so the capital mainly comes from small financing and lending.The financing demand of 77.27% of business owners is within 1 million yuan within one year,and 57.65%of business owners have loaned less than 500,000 yuan within one year.(Small and micro enterprises in China financing and wisdom report.2020)

Many years have passed and many children have benefited from various therapeutic2 riding programs. But none touched me as much as this one boy. He required a steady horse, one with patience with his rider s inability to balance and an understanding of the boy s need to occasionally lay his face on the mane and just breathe in horse smells. We had several wonderful horses that filled the bill.

2 Overview of the Chinese Banking Industry

At present,China's banking financial institutions can be divided into large commercial banks,joint-stock commercial banks,urban commercial banks,rural financial institutions and other financial institutions③.(Wenfeng Xiao.2021).

According to the List of Bank of China Financial Institutions on August 20,2021 (cbirc.2021),currently there are currently 4608 banks and financial institutions,including 12 joint-stock commercial banks,6 large state-owned commercial banks(ICBC,ABC,BOC,CCB,BCM,PSBC),1569 rural commercial banks,609 rural credit cooperatives (including 25 provincial rural credit cooperatives),26 rural cooperative banks,2642 rural banks,257 corporate group finance companies,130 urban commercial banks,71 financial leasing companies,68 trust companies,41 rural fund cooperatives,41 foreign legal banks,25 auto finance companies,29 consumer finance companies(Cbirc.gov.cn,(2021).List of Banking Financial Institutions).

Apart from the financial institutions approved by CBIRC,there are also small loan companies set up everywhere.According to the statistical report of small loan companies on July 28th,2021 and the first half of 2021,as of June 2021,there were 6,686 small loan companies nationwide at the end of June 2021.The loan balance was 886.5 billion yuan,up to 25 million④yuan in the first half of the year.Dectrend compared to 7333 reported on June 30,2020.

According to the list above,financial service institutions are matched to SMEs,but in reality,high-quality SMEs are more likely to get loans from the bank easily,.to ensure the cash flow of micro enterprises,relevant parties should make it easier for SMEs to apply for loans from the banks and obtain direct financing (such as enterprise issuing bonds is the highest).

3 The Node Problem Between Banks and Smes.

The structure of China's financial industry is imperfect,and the direct financing channels for enterprises are limited.It's difficult for most of the SMEs to get direct investment,and thus most SMEs choose to lend loans,which also reflects the single category of China's financial services,allowing SMEs to give priority to bank lending.However,the banking industry is not interested in the financing reception of SMEs.

The commercial banks issue loans to SMEs,mainly with appraised real estate mortgage as the first choice,but the proportion of credit loans for business owners or enterprises is very small.China's 30 million small and micro businesses have little real estate and are under credit in their initial stages.Eight million SMEs are in development or labor-intensive industries,with little cash or real estate,and are not high-quality assets in the eyes of banks.Therefore,making it hard for SMEs to borrow loans.

The current banking system stipulates that the bank credit officers and branch presidents should bear lifelong responsibility for making loans for private enterprises.From the perspective of banks,choosing low-risk and low-complexity projects is reasonable,so banks are not enthusiastic about lending loans to SMEs.

The large enterprises arrears the receivables of SMEs,resulting in the lack of loan audit indicators such as capital and credit,thus affecting the long-term development of SMEs and the evaluation of their loan repayment ability,increasing the financing difficulty of enterprises and the financing costs of enterprises.

The bank service objects are mainly large enterprises,industries and groups,the market positioning is mainly large and medium-sized cities,due to the small loan amount,large quantities,high risk,it is difficult to obtain a stable loan environment.The bank itself failed to adapt to the special loan needs of SMEs in institutional setting,product design,credit rating,loan management and other aspects.

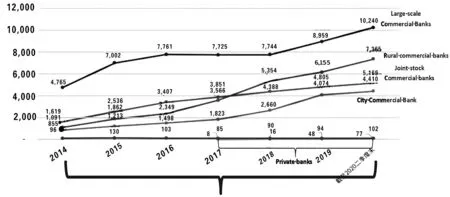

The proportion of non-performing loans to each bank is relatively large.The six largest commercial banks in China's banking industry,with its strong power,are relatively powerful in the business,year-on-year loans,also arranged in the former,as shown in Figure 1,the large commercial banks are represented by the dark blue line,remained in the highest position from 2014 to the second quarter of 2020.It is interesting that in 2017,the amount of non-performing loans of joint-stock commercial banks was basically equal to that of rural commercial banks,but in the following year,the non-performing loans of rural commercial banks exceeded the joint-stock commercial banks.In general,the amount of non-performing loans in China's banking industry has been on the rise in recent years,which account for why banking industry is not highly active for SMEs.

Figure 1 Non-performing loan balance of commercial banks

4 Major Problems and Suggested Solutions

4.1 Main Problems

(1)At present,57.65% of the business owners in the main financing needs of SMEs are less than 500,000 in a year,which is in contradiction with the habit of banks' direct preference towards large loans and are more willing to engage in large financing loans.

(2)In terms of borrowing period,59.96% of small and micro business owners borrow within one year and 34.06% within half a year.Borrowings are mostly used for the major businesses,including expanding the scale of production and operation (43.04%),shortterm turnover of working capital (33.53%),increasing fixed asset investment (15.49%),and only 7.93%⑤of small and micro business owners will repay existing loans,credit card overdraft repayment and other matters unrelated to the major businesses.For the business owners who have not failed to perform the special funds according to the agreement,there shall be a restraint mechanism.

(3)The two main factors that affect SMEs are that no available mortgage or guaranteed assets cannot obtain loans,bank loan interest rate is too high,as well as financial cost is,and repayment pressure is great.

4.2 Suggested Solutions

(1)Bank uses big data score instead of manual judgment,and decides whether to lend with comprehensive data such as business owners and corporate financial statements.

(2)Carries out spot inspection and supervision on the loan flow,and reduces or even cancels the credit line for the owners who are trust-breaking.

(3)For SMEs without mortgage or guaranteed assets,the form of science and innovation loans can be adopted,as technical achievements or patents are regarded as guaranteed assets,to ensure the timeliness of loans.

(4)For the problem of excessive loan interest,banks should give preferential interest rate reduction in combination with the requirements of national inclusive finance policy.

Notes:

①Chinadaily.com.cn.(2019).The national economic census report shows that the role of small,medium and micro enterprises is becoming increasingly significant.

②Zero one think tank.2020.China Inclusive Small and Micro Finance Development Report 2020.

③Wenfeng Xiao.(2021).Challenges and Countermeasures for Payment and Settlement Services of Commercial Banks in the Context of Internet Finance https://www.atlantis-press.com/article/125952851.

④GOV.CN/SHUJU.(2020).Statistical report of small loan companies in the first half of 2020.

⑤Yyfax.com.(2018).Small and micro enterprises in China financing and wisdom report.