基于過(guò)采樣SVM的不平衡數(shù)據(jù)信用評(píng)價(jià)模型

朱安安

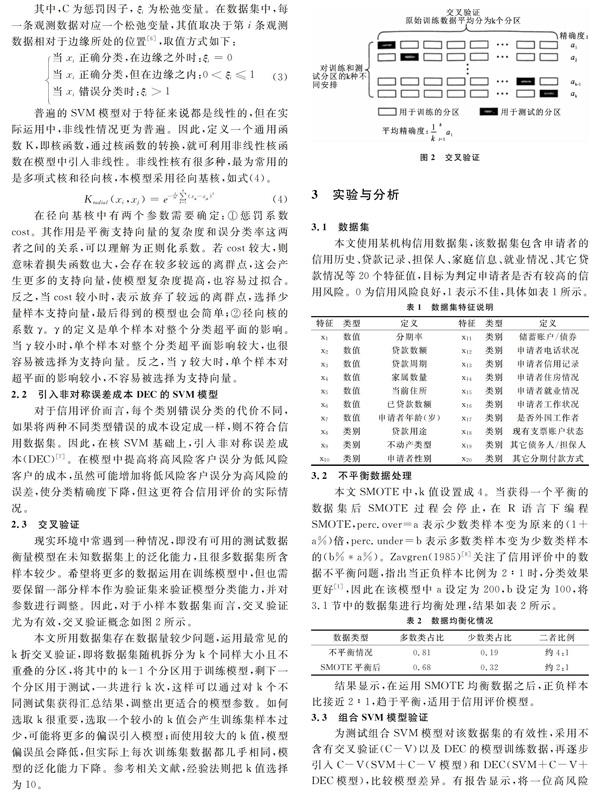

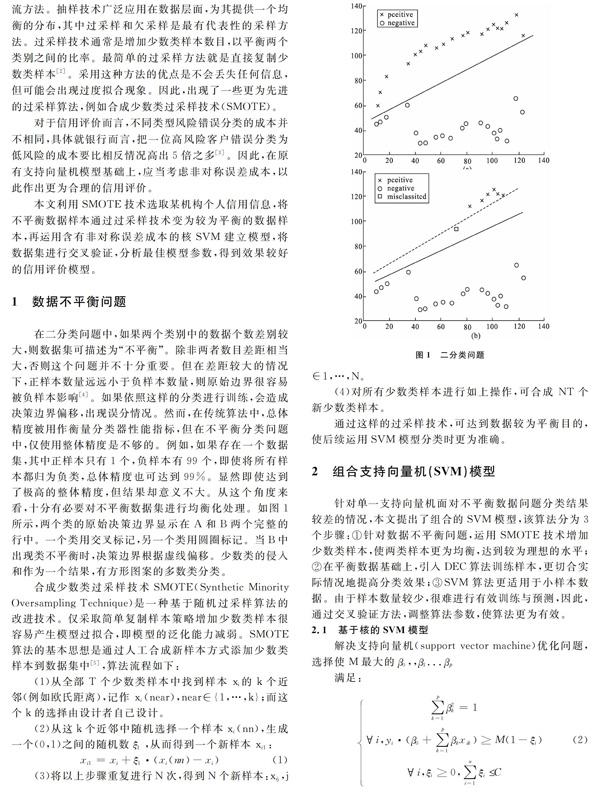

摘 要:針對(duì)信用評(píng)價(jià)中最為常見(jiàn)的不平衡小樣本數(shù)據(jù)集問(wèn)題,以及不同誤分類(lèi)造成的損失代價(jià)不同問(wèn)題,在傳統(tǒng)SVM模型基礎(chǔ)上,提出采用過(guò)采樣的SMOTE算法解決數(shù)據(jù)不平衡問(wèn)題。在核SVM模型的基礎(chǔ)上運(yùn)用交叉驗(yàn)證得出核最優(yōu)參數(shù),加入非對(duì)稱(chēng)誤差成本(DEC),提高將高風(fēng)險(xiǎn)誤分為低風(fēng)險(xiǎn)的成本,建立更適用于信用評(píng)價(jià)的模型。經(jīng)數(shù)據(jù)驗(yàn)證,該算法有效彌補(bǔ)了傳統(tǒng)SVM模型在不平衡數(shù)據(jù)集分類(lèi)中的缺陷,避免了小樣本數(shù)據(jù)集樣本過(guò)少而使得模型泛化能力降低的問(wèn)題。加入DEC之后的模型與未加入的相比,雖分類(lèi)準(zhǔn)確率略有降低,但將高風(fēng)險(xiǎn)誤分為低風(fēng)險(xiǎn)的錯(cuò)誤明顯降低,更適用于信用評(píng)價(jià)模型。

關(guān)鍵詞:信用評(píng)價(jià);不平衡數(shù)據(jù);SMOTE算法;支持向量機(jī);徑向基核;非對(duì)稱(chēng)誤差成本

DOIDOI:10.11907/rjdk.181205

中圖分類(lèi)號(hào):TP301

文獻(xiàn)標(biāo)識(shí)碼:A 文章編號(hào):1672-7800(2018)010-0064-04

英文摘要Abstract:Aiming at the commonest problem of unbalanced data set of credit scoring and the different cost caused by different classification error,based on the traditional kernel SVM model,we propose to use SMOTE to balance the unbalanced data.Cross-validation is used to get the optimal parameters,and then dissymmetric error cost (DEC) is used to establish a more suitable model for credit scoring.Through the data test,it is proved that the new model remedies the defect of traditional SVM model and avoids the generalization ability decreasing caused by the small sample data set.Compared with the model without DEC,the accuracy of classification is slightly lower,but the error of high risk classification error is lower than before.It is more suitable for the credit scoring model.

英文關(guān)鍵詞Key Words:credit scoring; unbalanced data; SMOTE; SVM; radial basis function kernel; dissymmetric error cost

0 引言

所謂信用評(píng)價(jià),通常指以一系列相關(guān)指標(biāo)作為考量基礎(chǔ),通過(guò)一定方法計(jì)算出個(gè)人或企業(yè)償付其債務(wù)能力和意愿的過(guò)程。自美國(guó)次貸危機(jī)發(fā)生以來(lái),各大金融機(jī)構(gòu)對(duì)個(gè)人信貸業(yè)務(wù)更為謹(jǐn)慎。為在控制風(fēng)險(xiǎn)與追求利潤(rùn)之間找到平衡,建立有效的個(gè)人信用評(píng)價(jià)(credit scoring)體系更為重要[1]。在西方發(fā)達(dá)國(guó)家,個(gè)人信用評(píng)價(jià)體系、技術(shù)已逐步完善成熟,而我國(guó)信用評(píng)價(jià)起步較晚,大多數(shù)商業(yè)銀行和征信機(jī)構(gòu)仍然采用傳統(tǒng)的人工經(jīng)驗(yàn)結(jié)合打分制評(píng)判是否放貸,隨著個(gè)人信用業(yè)務(wù)的迅猛增加,傳統(tǒng)方法已無(wú)法滿(mǎn)足現(xiàn)實(shí)需求。……

- 軟件導(dǎo)刊的其它文章

- 面向互聯(lián)網(wǎng)+創(chuàng)新的計(jì)算機(jī)網(wǎng)絡(luò)課程教學(xué)改革

- 基于物聯(lián)網(wǎng)的大學(xué)計(jì)算機(jī)專(zhuān)業(yè)實(shí)踐教學(xué)研究

- 移動(dòng)互聯(lián)時(shí)代碎片化學(xué)習(xí)研究現(xiàn)狀及趨勢(shì)分析

- 成果導(dǎo)向(OBE)下軟件工程專(zhuān)業(yè)實(shí)驗(yàn)課程教學(xué)改革研究

- 基于Hbase的健康監(jiān)測(cè)大數(shù)據(jù)平臺(tái)隱私保護(hù)研究

- 云存儲(chǔ)安全交叉加密算法研究